Highlights of Fiscal 2023

ESG

Measures Related to Climate Change

Enhanced scenario analysis based on the TCFD*1 recommendations

In fiscal 2022, the Company began conducting scenario analysis based on TCFD recommendations, and in the first year, in view of their importance, we conducted such analysis for two business divisions: the Vision Care Division (eyeglass lenses) and the MD Division (glass substrates for hard disk drives). In fiscal 2023, the scope of analysis was widened to include the Optics Division (optical lenses), and measures were formulated and implemented based on these analyses. We note that the combined CO2 emissions of these three business divisions account for 88% of the HOYA Group's total CO2 emissions. The Company publishes a report entitled TCFD Disclosure, which describes this scenario analysis in detail.

Introduction of renewable energy and promotion of CO2 reduction

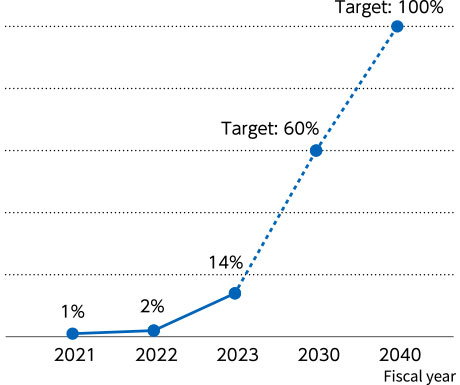

HOYA joined the RE100*2 initiative in February 2023 and has set a target to achieve a 100% renewable-energy usage rate by fiscal 2040. As an intermediate target, the Company aims to achieve a renewable-energy usage rate of 60% by fiscal 2030, and the entire HOYA Group is working to transition to renewable energy.

In fiscal 2023, four production sites installed solar panels (compared to one in fiscal 2022), and the switch to green power plans and purchase of non-fossil certificates resulted in a 14% renewable-energy usage rate, compared to 2% in the previous fiscal year.

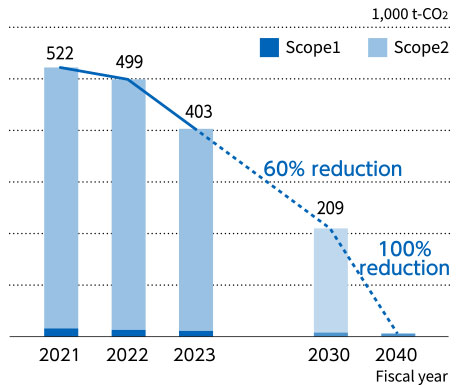

In fiscal 2023, Scope 1 and 2 emissions were reduced by 23% from the base year due to the impact of ongoing energy conservation activities and the adoption of renewable energy as well as changes in production volume associated with a temporary decrease in customer demand in some businesses. HOYA will continue to promote CO2 reduction activities by reviewing production processes, energy saving activities by improving the efficiency of production facilities, and the use of renewable energy for electric power.

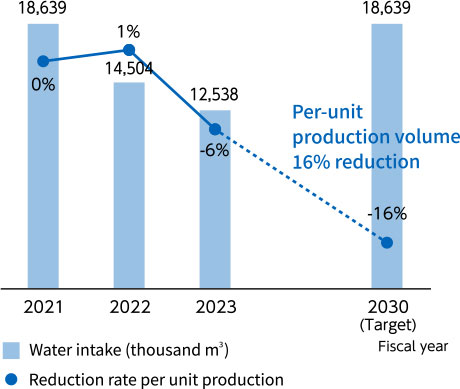

Introduction of Group water targets and promotion of activities to reduce water usage

The HOYA Group has been working to reduce water usage by setting reduction targets in each business division. In order to further accelerate these initiatives, we have now set water usage reduction targets for the entire Group.

Water usage reduction target: 16% reduction per production volume by fiscal 2030 compared to base year (fiscal 2021) (total volume will not exceed base year level)

We will continue our endeavors to reduce water usage by reviewing production processes and improving the water reuse ratio.

Calculation of Scope 3 emissions

First, we calculated all relevant categories based on fiscal 2022 data in a pilot project. Next, we identified the categories that were the major sources of emissions and conducted Company-wide calculations for the major categories.

For a detailed discussion, please read “Environmental.”

*1 Task Force on Climate-related Financial Disclosures

*2 “RE100” refers to “100% renewable electricity.” This international initiative commits influential companies worldwide to converting the energy they use in business activities to 100% renewable energy.

CO2 Emissions

Renewable-energy usage rate

Water intake

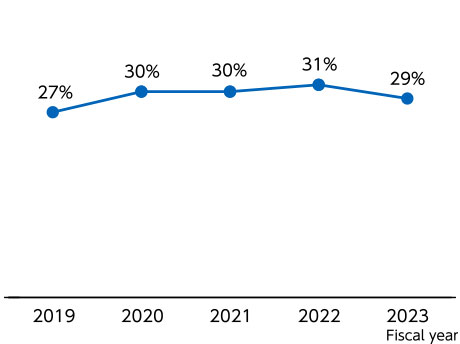

Water reuse ratio

Human Capital and Diversity & Inclusion

Employee engagement surveys

In September 2022, the HOYA Group conducted its third employee engagement survey targeting all HOYA Group employees worldwide. Based on the results, discussions at each workplace identified areas for improvement to create an even better work environment and implemented the results into an action plan. Furthermore, a fourth engagement survey will be conducted in fiscal 2024, and a series of measures will be continued after analyzing the results obtained.

Management framework (performance evaluation system)

We believe it is essential to have a system that enables fair and objective evaluation of performance in order to motivate employees in expressing their abilities to the fullest. In fiscal 2022, the Group began operating a new, common global framework for performance evaluation, which was developed based on the previously used framework. In addition to reflecting the results of performance evaluations in compensation, we also provide regular and effective feedback for the purpose of personnel development.

Introduction of career development programs

Providing employees with ample opportunities to update their knowledge continuously and pursue reskilling is vital in supporting enterprise competitiveness. To this end, the HOYA Group has introduced an on-demand online learning platform (LinkedIn Learning) to support the career development needs of the employees who support HOYA’s growth strategy.

Promotion of diversity & inclusion

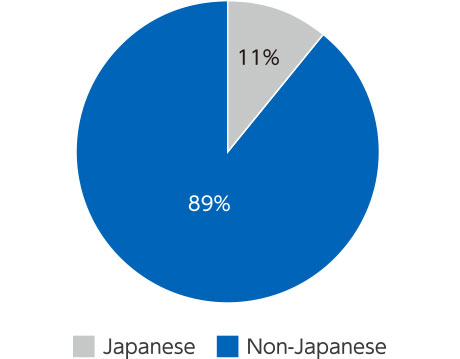

The HOYA Group believes that respecting and embracing diversity and proactively leveraging “differences” among its people will enable it to respond flexibly to the ever-changing business environment and diversifying customer needs, which in turn will lead to the creation of corporate value. The Group has been hiring based on the abilities of each individual without regard to nationality, gender, or other attributes. More than 90% of the Group’s employees are based outside of Japan. As such, we are promoting the globalization of the entire Group by actively recruiting talented local personnel and increasing opportunities for them to play active roles. As a result, approximately 90% of our overseas subsidiaries are led by non-Japanese executives.

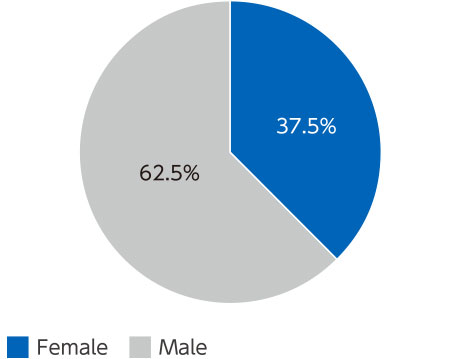

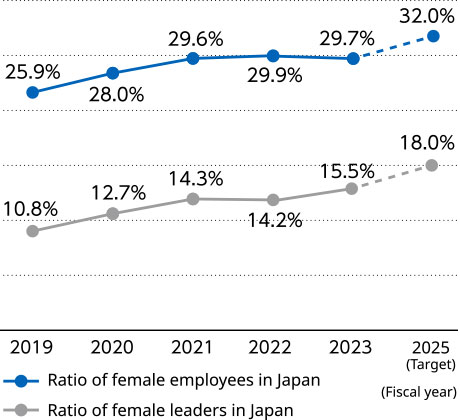

In terms of gender diversity, the percentage of female officers and executive officers (total of directors and executive officers) is high at 37.5%, and the ratio of female employees and managers in Japan, which has been an issue, is also improving.

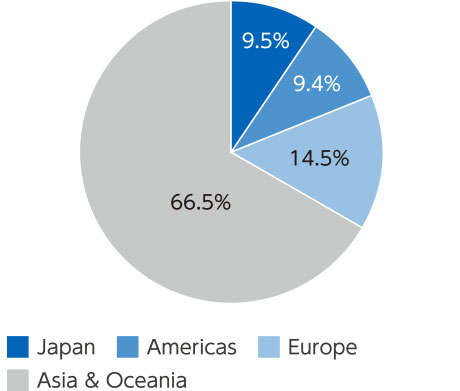

Ratio of Employees

Executive ratio at overseas subsidiaries

Ratio of female officers

Ratio of female employees and leaders in Japan

Strengthening ESG Governance

Board of Directors’ monitoring function

The HOYA Group’s outside directors have sufficient management experience and international perspectives. Furthermore, its outside directors have knowledge and experience in the sustainability/ESG field, including climate change, human capital development, and leadership development. The Board of Directors receives regular reports from the Chief Sustainability Officer (CSO) on sustainability-related issues and initiatives at the Group level (twice a year during the current fiscal year) and monitors progress. In addition, during business reviews of each business division by the Board of Directors, reports are received on the climate change response of the relevant business and advice provided from a multifaceted perspective. Furthermore, the Group Chief Human Resources Officer (CHRO) reports regularly to the Board of Directors on human resources policies for the entire HOYA Group, while the Group Chief Compliance Officer (CCO) reports regularly to the Board of Directors on matters related to compliance (once a year in the current fiscal year, respectively).

Incorporating ESG indicators into incentives

In fiscal 2022, the HOYA Group introduced ESG indicators in the Performance Share Unit (PSU), which is a medium- to long-term incentive for Executive Officers' compensation, and set targets based on evaluations by external organizations and the status of initiatives on priority ESG themes (including climate change and human capital). In fiscal 2023, the HOYA Group increased the allocation of ESG targets to 25% from 10% to further clarify its commitment to ESG.

Furthermore, from fiscal 2023, the annual incentives for division presidents of each business division will be made more effective by incorporating important KPIs among the ESG-related targets set by each business division into the evaluation items (e.g., renewable-energy usage rate).

Expansion of Disclosure and External Evaluation

Status of Adoption by GPIF ESG Indexes

HOYA has been selected as a constituent of the following ESG indexes adopted by the Government Pension Investment Fund (GPIF) of Japan.

-

FTSE Blossom Japan Sector Relative Index(General index)

-

2024 CONSTITUENT MSCI JAPAN ESG SELECT LEADERS INDEX(General index)

-

2024 CONSTITUENT MSCI JAPAN EMPOWERING WOMEN INDEX (WIN) (Thematic index: social initiatives)

-

Morningstar Japan ex-REIT Gender Diversity Tilt Index (Thematic index: social initiatives)

HOYA is rated Group 1, the highest of the five levels.

-

S&P/JPX Carbon Efficient Index (Thematic index: environmental protection)

HOYA has also been selected for inclusion in the following

MSCI ESG Leaders Indexes

2024 CONSTITUENT MSCI NIHONKABU

ESG SELECT LEADERS INDEXMSCI Japan Climate Change Index

Main ESG Rating Status

MSCI ESG rating: AAA (highest of seven ratings, achieved for two consecutive years)

Sustainalytics ESG risk rating: Low Risk

CDP Climate Change: B Score (Up 2 notches from C score in previous fiscal year)

Other External Evaluations

Selected by GPIF’s external asset managers for “most-improved integrated reports”

Certified by the Ministry of Economy, Trade and Industry (METI) as an outstanding health and productivity management organization for eight consecutive years

R&I rating: AA

As of June 30, 2024

*1 FTSE Russell (registered trademark of FTSE International Limited and Frank Russell Company) hereby certifies that HOYA has qualified for inclusion in the FTSE Blossom Japan Sector Relative Index as a result of independent research. The FTSE Blossom Japan Sector Relative Index is widely used to create and evaluate sustainable investment funds and other financial products.

*2 The inclusion of HOYA in any MSCI Index, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement or promotion of HOYA by MSCI or any of its affiliates. The MSCI Indexes are the exclusive property of MSCI. MSCI and the MSCI Index names and logos are trademarks or service marks of MSCI or its affiliates.

*3 Morningstar, Inc., and/or one of its affiliated companies (individually and collectively, “Morningstar”) has authorized HOYA CORPORATION to use the Morningstar Japan ex-REIT Gender Diversity Tilt Logo (“Logo”) to reflect the fact that, for the designated ranking year, HOYA CORPORATION ranks in the top quintile of companies comprising the Morningstar® Japan ex-REIT Gender Diversity Tilt IndexSM (“Index”) on the issue of gender diversity in the workplace. Morningstar is making the Logo available for use by HOYA CORPORATION solely for informational purposes. HOYA CORPORATION use of the Logo should not be construed as an endorsement by Morningstar of HOYA CORPORATION or as a recommendation, offer or solicitation to purchase, sell or underwrite any security associated with HOYA CORPORATION. The Index is designed to reflect gender diversity in the workplace in Japan, but Morningstar does not guarantee the accuracy, completeness or timeliness of the Index or any data included in it. Morningstar makes no express or implied warranties regarding the Index or the Logo, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the Index, any data included in it or the Logo. Without limiting any of the foregoing, in no event shall Morningstar or any of its third party content providers have any liability for any damages (whether direct or indirect), arising from any party’s use or reliance on the Index or the Logo, even if Morningstar is notified of the possibility of such damages. The Morningstar name, Index name and the Logo are the trademarks or services marks of Morningstar, Inc. Past performance is no guarantee of future results.