HOYA conducts research and development, manufacturing, and sales of eyeglass lenses.

Our product lineup includes single-vision lenses that possess a single corrective function for each lens; progressive lenses (varifocal lenses) that offer wide visual fields and a seamless transition between near, intermediate, and far distances in a single lens; as well as light-adaptive, photochromic lenses, which darken to a sun tint outdoors and fade back to clear inside.

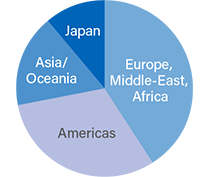

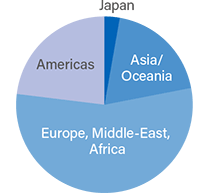

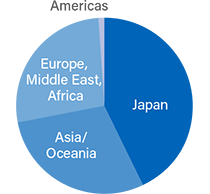

In terms of sales by region, Europe is the largest market, followed by the Americas and the APAC region. Overseas sales account for approximately 90% of total sales.

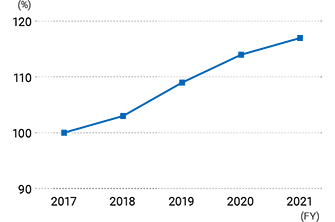

Going forward, demand for eyeglass lenses is expected to continue to increase worldwide, and market growth in the low single digits is expected over the medium to long term. The reasons for this include the global increase in the elderly population, the increase in purchasing power resulting from economic growth in emerging countries, the growing awareness of eye health, and the deterioration of eyesight as people spend more time using digital devices.

With regard to the impact of the new coronavirus, business is normalizing with the progress of vaccinations in various countries and the resumption of economic activities.

As for the conflict in Ukraine, we are operating in Eastern Europe (Russia, Ukraine, and Belarus), and currently our business in Russia is temporarily limited to healthcare-related activities and within the scope of international trade restrictions. In fiscal 2021, revenue from sales of eyeglass products in Eastern Europe accounted for 1% of global revenue.

We provide humanitarian assistance to Ukraine. For more information, please click here.

The contribution to global growth varies per region. North America, Europe, and Japan being the mature markets will continue to play a significant role in the overall market; while faster growth is expected from emerging markets from increased availability of vision protection products and growing middle-class populations, such as in the Latin America and Asia-Pacific regions.

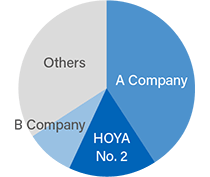

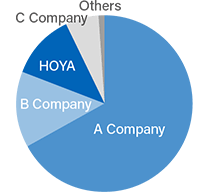

HOYA stands at the No. 2 position in the industry, and, in addition to organic growth, has expanded its share of the market through M&A initiatives, including the 2013 acquisition of SEIKO’s eyeglass lens unit, and U.S.-based Performance Optics, LLC. in 2017.

Eyeglass lens products account for over 50% of Life Care business sales, and are a growth driver for Life Care business expansion.

We are strengthening sales activities in Asia, with a focus on China, as well as in several growth markets in South America to expand our market share.

Additionally, in the United States, we continue to focus on expanding sales to key accounts and chain stores, on top of the strongly established presence among independent opticians. With these opportunities and focus areas, we aim to achieve low-to-mid single-digit percent growth, which is faster than the market. On top of that, we will also continue to pursue M&A opportunities to boost growth.

On the production side, we are investing globally to meet growing demand and to diversify our production sites.

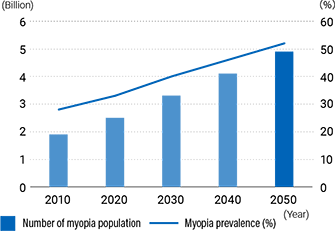

The rapid progression of myopia is becoming a global health challenge. An estimated five billion people, or roughly half of the global population, could be affected by shortsightedness by 2050.

Together with the Hong Kong Polytechnic University, HOYA developed “MiYOSMART,” an innovative spectacle lens for myopia control.

Commercialization of this product started in 2018. MiYOSMART is currently available in several markets, mainly in Asia and Europe, and has been growing rapidly. We plan to gradually obtain approvals and expand our sales footprint.

Note: As of August 2022, MiYOSMART has not received approval in Japan and the United States.

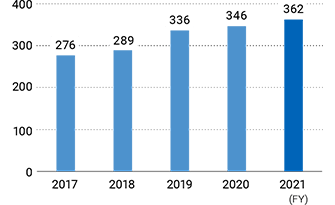

In Japan, we are expanding Eyecity outlets, HOYA’s contact lens specialty retail store chain.

At Eyecity, we offer consulting and sales, making product recommendations ideally suited to the needs of individual customers, and, leveraging our strength, we provide a wide lineup sourced from major manufacturers throughout the world.

Stores are established in convenient locations, in close proximity to train stations, inside shopping centers, and other areas.

The contact lens retail market in Japan temporarily shrank as a result of the reduction in the frequency of contact lens use, due to the increase in Work From Home (WFH) and homeschooling opportunities, the decrease in opportunities to go out and other such factors attributable to the impact of COVID-19. While the COVID-19 infection situation has repeatedly been undergoing a cycle of improvement and deterioration and requires caution, sales have been robust due to increased store traffic. (If any restriction on movement, etc., is imposed going forward, it is expected to have a negative impact.)

As for the market's future outlook, the market is expected to continue expanding going forward, albeit slightly, due to such factors as the increase in contract lens demand stemming from the increasing percentage of nearsightedness among the younger generation and the rising age of contact lens users in association with the growing prevalence of multifocal contact lenses, combined with the rise in the average unit sales price attributable to the increase in sales of high-value-added lenses.

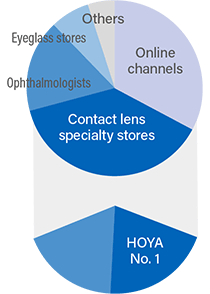

By sales channel, the share of Internet shopping is expected to expand, while the share of the contact lens specialty store channel is expected to be steady.

HOYA holds the top share in the retail channel for sales made through brick-and-mortar stores.

On top of sales growth at existing stores based on, among others, the promotion of high value-added products, we are working to expand sales by opening new stores, including M&A. We also provide online sales services in the form of “Hoshii Toki Bin” (meaning on-demand delivery) and “Otoku Teiki Bin” (meaning money-saving regular delivery) to adapt to Internet shopping, which has been expanding in recent years. These services have been used by many people, especially at the height of the COVID-19 pandemic.

Going forward, HOYA will seek to achieve ongoing sales growth at a rate of around 5% through the growth of sales at existing stores by such means as expanding the sales of high-value-added products and stressing the appeal of delivery services that are in high demand in the market, as well as the opening of new stores, including M&A.

For new stores, HOYA will conduct detailed analyses of an area’s contact lens-wearing population, market growth rate, and competitive situation, and will establish stores mainly in city centers, regional cities, and large shopping centers. We will also strive to increase efficiency by relocating stores within the same marketing area as appropriate. In addition, we will work to accelerate growth by actively exploiting M&A opportunities targeting contact lens specialty stores that have a strong position in their respective local markets.

In response to heightened market demand for Internet shopping, we will highlight the appeal of delivery services that enable consumers to place orders periodically or whenever necessary. We will also look into solutions for Internet shopping channels that are expected to continue growing in terms of share in the future.

HOYA conducts research & development, manufacturing, and sales of medical flexible endoscopes used in the examination and treatment of digestive system, ear, nose & throat (ENT), respiratory organ, etc.

By geographical region, sales in Europe and other overseas markets account for a large portion of total sales.

Medical expenses are increasing worldwide in line with the aging of society. To keep medical expenses in check, governments in countries across the globe are promoting the early detection of disease and minimally invasive medical procedures.

Also, endoscopes are attracting a great deal of attention due to the demand for minimally invasive medical treatment, which does not involve the use of a scalpel on the patient’s body and thus minimizes the physical burden on the patient.

The growth of the endoscope market is modest in Japan, the United States, Europe, and other developed countries and regions. However, its growth rate remains high in Asia—especially China—which is at a stage where endoscopes are becoming more prevalent. While our forecast remains unchanged in that the Chinese market is expected to continue serving as the driving force for the global market in the future, Chinese government institutions are promoting policies to give priority to Made-in-China products in the bidding process and medical equipment manufacturers outside China are being required to produce locally in China.

In fiscal 2021, the market continued to grow due to such factors as the recovery in medical institutions’ willingness to make investments and the increase in demand after bouncing back from the COVID-19 pandemic. However, the global shortage of electronic components supply has led to a tight supply of endoscopes relative to demand. Although the supply volume of semiconductors is gradually increasing, the situation is unstable.

In the medium/long term, HOYA expects the endoscope equipment market to grow at a rate of around 7% on a global scale.

HOYA is the second largest group in the industry, with its strengths lying in high image quality, ultrasonic endoscopes, small-diameter endoscopes that strike a balance between image quality, exterior diameter and channel size, and public health-conscious products.

In terms of geographical region, HOYA will strive to achieve growth by enhancing sales activities in Asia and the Americas while securing stable earnings in Europe, which accounts for about 50% of total sales.

In terms of products, we will pursue product differentiation by further developing treatment instruments used in combination with endoscopes as well as disposable endoscopes, while steadily executing initiatives targeted at products for digestive organs, the main battlefield in the flexible endoscope market.

In the field of disposable endoscopes, HOYA’s first disposable bronchoscope, “PENTAX Medical ONE Pulmo,” obtained CE mark certification in Europe in May 2021. Moving forward, we will expand sales in Europe and obtain approval in other regions. HOYA’s strength lies in its ability to propose either conventional endoscopes or disposable endoscopes depending on the purpose and the situation, and in its disposable endoscopes that have also realized high quality, suction power and operability equivalent to conventional endoscopes. Although the presence of disposable endoscopes is not yet strong enough to largely replace conventional endoscopes at this stage, their presence is expected to grow in the medium to long term, so this is regarded as a stepping stone for us.

In this field, we perform research and development, manufacturing, and sales of intraocular lenses (IOLs) for cataract surgeries and ophthalmic medical devices.

With nearly 35 years of experience in designing and producing IOLs, HOYA Surgical Optics’ mission is to improve the vision and quality of life for millions of people suffering from cataracts.

A cataract is a condition that becomes more common as we age and is the largest cause of vision loss in people around the world. A cataract is treatable with surgery and it is one of the most performed surgical procedures in the world. A cataract surgery replaces the natural lens that has developed the cataract with a new clear IOL.

The rich HOYA heritage and expertise in developing optical products and technologies coupled with the wealth of knowledge that we have accumulated in developing IOLs and injectors makes us the provider of the world’s most trusted fully pre-loaded IOLs* and has allowed us to gain market leadership in the fully pre-loaded IOL category worldwide.

* In a pre-loaded injector, the intraocular lens is pre-installed in the injector, supporting surgeons to perform safer and more reliable surgery.

By region, sales in Japan account for approximately half of total sales.

The market continues to grow roughly 7% per year in the near term, against the backdrop of the global aging population, the spread of medical infrastructure in emerging countries, increasing accessibility to advanced medical technologies, and pent-up demand. On top of that, premium products such as multifocal and deep depth-of-focus types of IOLs are driving market growth.

In fiscal 2021, recovery from the impact of the COVID-19 pandemic has progressed, although there are differences among countries and regions. Going forward, we expect the number of cataract surgeries to recover in Japan, where recovery has been lagging, and the market to return to a growth trajectory.

Driven by the flagship brand, Vivinex™, sales continue to grow at a pace that is above the market. Vivinex™ combines an IOL material that offers unprecedented clarity of vision with multiSert™, our proprietary 4-in-1 injector, which is designed to provide outstanding IOL delivery consistency.

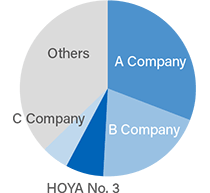

HOYA is steadily increasing its market share and currently holds the global No. 3 position.

We have further expanded our portfolio with the addition of a family of Trifocal IOLs. This has allowed us to enter the highly profitable segment of presbyopia correcting IOL market. HOYA offers a comprehensive solution to cover any customer need and expectation in the field of cataract surgery.

Furthermore, we will expand customer reach by bolstering our sales workforce in regions in which we already have sales bases and entering into new regions one by one, whether directly or indirectly (collaboration with sales agents), in pursuit of higher sales.

In China, where the market is expected to expand in the future, we established a joint venture company with our existing partner and distribution agent GeMax in May 2020, to further increase sales by steadily absorbing demand in China.

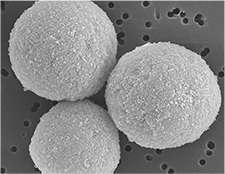

HOYA deals in ceramic and metal implants used for filling deficient parts and joining fractured segments of bones, as well as bioceramics used in the development and production of bio-pharmaceutical products and cell culture.

Implants are mainly sold to medical institutions in Japan, while bioceramic chromatography media are sold to pharmaceutical companies and research institutions around the world through distributors.

The market of implants for neurosurgery/spinal surgery and orthopedic surgery in Japan is expected to grow at a low single-digit rate due to the increasingly aging population. In the market of implants for Neuro-Spine surgery, HOYA is a market leader, having been the first in Japan to manufacture and sell a hydroxyapatite product with more or less the same constituents as a human bone. HOYA entered the market of implants for orthopedic surgery through management integration with Japan Universal Technologies, Inc. in 2012. We are manufacturing and selling metal implants that are optimized to the skeletal structure of Japanese people in terms of shape and size.

The market of separation/purification media (chromatography media) used in the development and production of biopharmaceutical products is expected to grow at a rate of approx. 10% globally in the years ahead, due to the expansion of the biopharmaceuticals market. The media used varies with differences in the separation/purification method; HOYA’s spherical ceramic hydroxyapatite media are characterized by their extremely high absorbability of various proteins. HOYA provides the market with a unique product whose strength lies in its superior performance in terms of impurity removal separation in the purification process for biopharmaceutical products.

We will further accelerate growth by enhancing our product lineup, cultivating new applications and strengthening our marketing capabilities.

In the field of ceramic implants, we will maintain our current position and strive to further expand the market by cultivating new applications, while in the field of metal implants, we will increase our market share by enhancing our product lineup and strengthening our marketing capabilities in an effort to accelerate the growth of implants as a whole. For bioceramic chromatography media, we will not only accelerate the development of products and purification processes in cooperation with our customers and research institutions to meet the diversifying needs for bio-pharmaceutical products such as antibody drugs, vaccines and even gene therapy but also expand our production capacity to meet the growing demand in pursuit of further growth.