In this business, we perform research and development, manufacturing, and sales of mask blanks for semiconductors.

Critical in the semiconductor fabrication process, photomasks are the master plates used to transfer a semiconductor’s intricate and complex circuit pattern onto a semiconductor wafer, and mask blanks are the raw material used for photomask manufacturing.

Because photomasks are created for each individual circuit pattern, mask blanks are essential to new products developed by semiconductor manufacturers, foundries, and other HOYA customers, and in the R&D stage of new manufacturing technologies such as those of extreme ultraviolet (EUV) lithography.

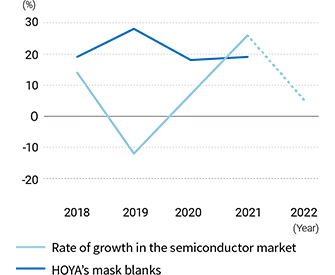

In 2021, the electronics market experienced an increase in shipment of personal computers, smartphones, servers and other major finished products. This led to higher demand for logic devices, memory, analog semiconductors, etc., translating into 26% growth in the semiconductor market overall. In 2022, the semiconductor market is expected to grow by 16%, driven by logic devices, memory, analog semiconductors, etc. (WSTS estimate)

Going forward, the growth of the market for mask blanks is expected to continue, given that semiconductor manufacturers and foundries are briskly conducting research and development activities aimed at the further miniaturization of electronic circuits using extreme ultraviolet (EUV) lithography—a cutting-edge manufacturing technology—and that customers’ research and development demand is the key driving force for the demand for mask blanks.

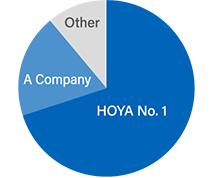

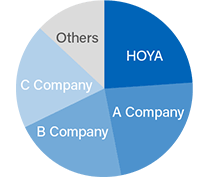

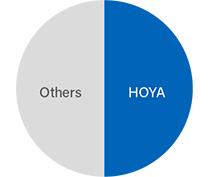

We have maintained a large share of the market over the long term by leveraging our strength, that is, our position as a leader in boosting semiconductor performance.

Moreover, we have continued to conduct EUV blanks research for nearly 20 years, and have demonstrated a firm presence in this field which has exceptionally high hurdles to clear for entry.

HOYA is enjoying an ever-growing presence as the only manufacturer that has rolled out both EUV and optical (existing non-EUV lithography technology) products.

Along with the advance of miniaturization in semiconductors, it appears that demand for mask blanks for EUV lithography will continue to be strong in the future.

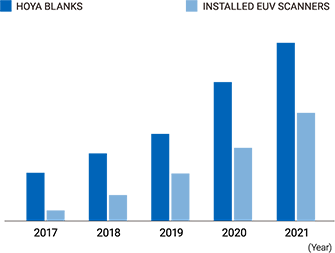

Mask blank sales are difficult to accurately predict due to the dramatic fluctuations that occur in line with customers’ development speeds, and also because they are not consumables and are not necessarily linked to movements in the semiconductor industry as a whole. However, in regards to products for EUV applications, the cumulative number of EUV lithography machines installed is deemed as one of the indicators of growth of the EUV market.

HOYA expands its manufacturing line as appropriate to meet customer demand. We added a manufacturing line for mask blanks for EUV lithography in 2020 and plan to further expand our production capacity by making additional investments in 2022 and subsequent years. We will continue making investments to expand production in a timely manner to meet the increasing demand in the future.

In the field of High-NA EUV scanners (next-generation EUV scanners), which are slated to be used in production from 2025 onwards in pursuit of further miniaturization, the challenge is to tackle the 3D mask effect, by which the circuit pattern transferred to a semiconductor wafer is deformed as a result of diagonally-incoming light being blocked by the photomask’s absorber. To resolve this, we are carrying out development to make the absorber thinner with our partner in the supply chain of semiconductor production.

HOYA conducts research and development, manufacturing, and sales of photomasks used for manufacturing FPDs*1 such as LCD*2 and OLED*3.

When manufacturing FPDs for TVs, smartphones, laptop computers, and other devices, photomasks for FPD manufacturing are used as the master plates to transfer the circuit pattern onto the substrate.

HOYA sources the substrate from raw materials manufacturers, and on that substrate performs polishing, deposition, and resist applications (blanks manufacturing). When the manufacture of the blanks is completed, HOYA conducts circuit pattern drawing, developing, etching, and resist stripping and cleaning, and delivers it to panel manufacturers (photomask manufacturing).

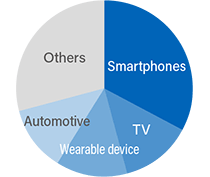

The ratio of sales by application is stated as follows.

While the ratio of sales of smartphone applications is the highest, in-vehicle, wearable and other new applications are increasing.

In fiscal 2021, panel manufacturers briskly engaged in research and development activities aimed at spurring new demand as panel prices settled. This led to higher research and development demand for photomasks, translating into market expansion.

Going forward, the market is expected to grow modestly due to such factors as the increase in demand for photomasks for small- and medium-sized OLEDs used in smartphones, etc. In terms of geographical region, the Chinese market is expected to grow.

HOYA possesses expertise in high-precision products, and holds the top-class market share.

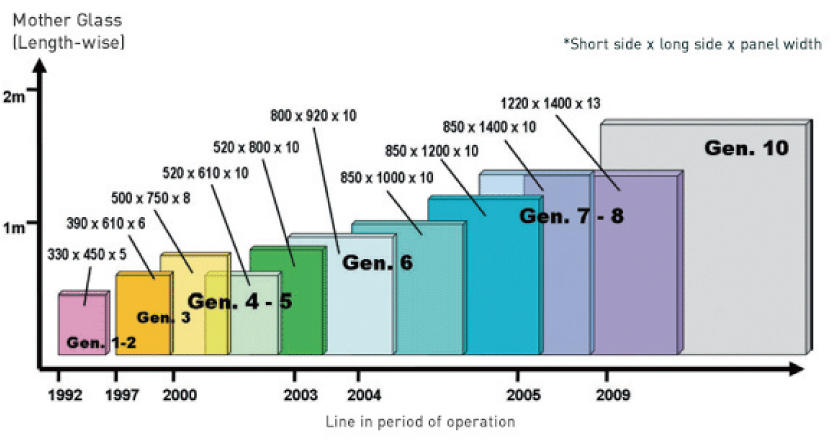

We will strive for steady business growth focusing on high-precision Gen. 6 products where there are future prospects for growth and on the Chinese market in terms of geographic region.

In October 2021, HOYA entered into a merger agreement with the BOE Group—a major panel manufacturer in China—with the aim of enhancing its FPD photomask production capacity in the Chinese market and decided to establish a joint venture company in China.

(The joint venture company will be established after the conclusion of various ancillary contracts and the completion of legal clearance and other procedures in the relevant countries, including China.)

FPD (LCD, OLED, etc.) manufacturing lines are categorized by generation, which corresponds to mother glass size. The size of mother glass has become progressively larger year by year not only because TV screens have become bigger, but also for the purpose of enhancing productivity by increasing the number of panel configurations per sheet. Growth is expected to continue going forward also with respect to small- and medium-sized panels centering on Gen. 6, in which HOYA has an edge, driven mainly by demand for OLEDs for smartphones.

In this area, HOYA conducts research and development, manufacturing, and sales of glass substrates for hard disk drives (HDDs). HDDs are used as internal storage for servers and personal computers, as well as external HDDs for personal computers and TVs.

Since HOYA’s full-fledged entry into the market of 3.5-inch substrates for data center servers in 2017, the business has continued to undergo high growth to the extent that it accounted for 60% of the sales of the business segment in terms of amount in fiscal 2021.

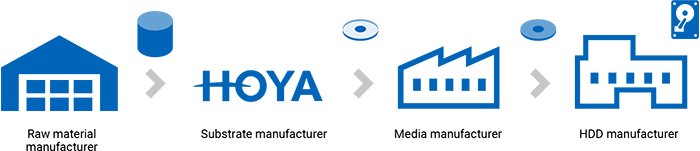

From raw material manufacturers, HOYA sources substrate raw materials, which we process in ways such as making it into a disc shape, enhancing its shock resistance, and polishing. After processing, we deliver this substrate to the media manufacturer where magnetic film is applied, among other film-forming processes, and it undergoes burnishing (final polishing) and other treatments before being shipped. In hard disk manufacturing, the HDD manufacturer assembles the hard disk, head, and other components, tests the completed product, and then ships.

Note: Media production is primarily carried out by HDD manufacturers.

HOYA’s 3.5-inch substrates are used in nearline (NL) storage used for backup and other purposes, mainly at data centers.

In the 3.5-inch HDD market, NL servers, having a comparatively low access frequency with backup applications, predominantly use HDDs due to their cost advantages over solid state drives (SSDs). Although data center-related investments made by large-scale cloud service vendors fluctuate in the short term, ongoing market expansion is expected in the medium and long term as data generation volumes expand throughout the world.

In the fields of laptop computers, external HDDs, and mission-critical servers, the market for 2.5-inch HDDs is shrinking, as they are being replaced by solid state drives (SSDs), which have faster data read/write speeds. In fiscal 2021, the demand for 2.5-inch HDDs was relatively high due to the impact of COVID-19, slowing down market contraction as a whole. This is deemed to have been attributable to the high demand for HDDs and external HDDs for personal computers due to the continuation of high demand for personal computers arising from Work From Home (WFH) and homeschooling, combined with the high demand for HDDs for servers due to the recovery of on-premise expenditures that had plummeted in the previous year.

Currently, all 2.5-inch substrates are made of glass. As the sole glass substrate manufacturer in the market, HOYA supports the HDD industry behind the scenes.

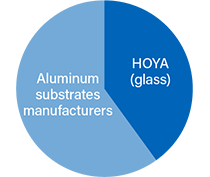

In the 3.5-inch substrate segment, products made of aluminum used to completely dominate the market based on their price advantage. However, our glass substrate products are now being adopted for HDDs as they are highly rigid and can increase the number of mounting disks by thinning the disks, and their market share in volume terms has risen to 40%. As the storage capacity of HDDs expands, our market share is also expected to expand.

Sales of 3.5-inch substrates are expected growth in line with the continued expansion of the market. In the medium term, growth is expected to accelerate through the acquisition of new customers; we will switch existing manufacturing facilities and utilize the new plant in Laos to meet the increase in demand.

In response to the expansion of data volume and the storage volume generated worldwide, HDD manufacturers are continually introducing in the market new products with higher data capacity per HDD.

The increase in data capacity per HDD has been realized by increasing the recording density or area of the disk, but, at present, the development of technologies designed to improve recording density is stagnating, and the expansion of the recording area remains key to capacity expansion.

In the 3.5-inch market, the disk material is now mainly aluminum alloy. However, since a further increase in area can be realized by increasing the number of mounting disks by thinning the disks, it is becoming necessary to use glass instead of aluminum alloy as the former has higher rigidity and allows for more thinning.

In the future, if the number of disks mounted in a single HDD increases to 11, the substrate’s thickness is expected to become 0.5mm or less, in which case the productivity of aluminum substrates is expected to fall, and from 2024 onwards, substrates for nearline (NL) storage is projected to be in short supply.

In the event that Heat-Assisted Magnetic Recording (HAMR)—a next-generation recording technology for higher recording density—is realized and commercialized, glass substrates with high thermal resistance will be the only option because HAMR requires high temperature in the magnetic film production process (the heatproof temperature of glass is 691 degrees Celsius, whereas that of aluminum alloy is 290 degrees Celsius).

While 2.5-inch substrate products are expected to decrease as more and more HDDs in external HDDs, personal computers and mission-critical servers continue to be replaced with SSDs in the future, we will pursue the growth of the business as a whole by offsetting this with an increase in sales of 3.5-inch substrate products.

In this area, we conduct research and development, manufacturing, and sales of optical lenses for a variety of cameras, as well as for optical glass materials.

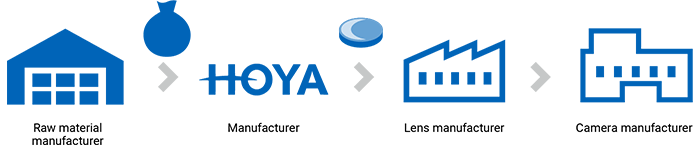

HOYA sources materials from optical glass material manufacturers, conducts compound and solution treatments, manufactures lens materials and lens products, and delivers to lens and camera manufacturers.

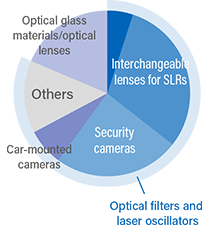

The ratio of sales by application is as the right figure.

Digital camera-related items for compact digital cameras, interchangeable lenses, etc. that had previously made up the majority of sales are trending down, and now account for approximately 40% of total sales.

The amount of shipment of interchangeable lenses for single-lens reflex (SLR) cameras and mirrorless cameras substantially increased due to the increase in sales of new products for high-end cameras and the recovery from the previous year when sales had suffered from the impact of COVID-19.

From research and development of optical glass composition to manufacturing of finished products of lenses, HOYA takes a consistent approach to its activities while building a structure that makes possible the mass production of an array of products.

HOYA maintains a high market share with its exceptional skills in aspherical glass molded (GMO) lenses.

GMOs are formed by directly pressing optical glass that has been subjected to high temperatures to make it malleable. These are optical lens products that require no polishing, and possess an excellent ability to correct distortions. Enabling a high angle design, the number of lenses used in optical systems can be reduced, and this contributes to compact, lightweight, and highly functional end-product cameras.

Applications for interchangeable lenses for SLR cameras are not expected to decrease as drastically as before due to the increase in sales of high-end cameras.

We will steadily expand the sale of optical products for new applications such as car-mounted cameras in an effort to stabilize the business as a whole.

For new applications, we are enhancing our sales activities for the adoption of HOYA products in advanced driver-assistance systems (ADASs), optical zooms for mobile devices and Augmented Reality (AR)/Mixed Reality (MR). In particular, their potential in the market of car-mounted cameras for image recognition in ADASs looks promising; we expect them to make a significant contribution to our business results when the practical application of this technology goes into full swing in a few years’ time.