HOYA’s portfolio management aims to secure profitability, stability, and growth potential of the Group as a whole by operating multiple businesses with different characteristics in terms of business model, sensitivity to economic cycles, etc., to diversify risk.

We examine each business to determine its stage in the lifecycle and allocate more management resources to areas with higher growth potential. We construct our business portfolio based on the survival of the fittest principle by, for example, withdrawing from a business that has lost its competitive edge.

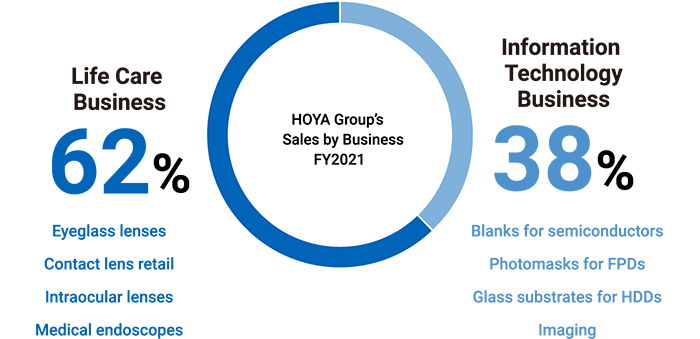

The present two business areas for portfolio management are Life Care and Information Technology.

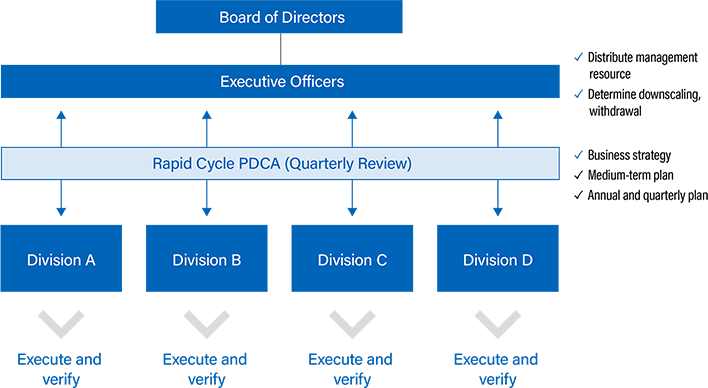

Based on the idea that “the accumulation of short-term results will produce long-term growth,” we conduct rapid-cycle reviews and improvement activities on a quarterly basis.

After receiving explanations on growth strategy and operating results from each business division, executive officers make decisions on the allocation of management resources to each business as well as any business downscaling or withdrawal decisions, which is the foundation of our business portfolio management.

Going forward, the Life Care business is expected to continue undergoing stable growth in the long term, on the back of the aging population worldwide and the increasing demand for a higher quality of life (QOL) among people stemming from economic growth in emerging countries. The Information Technology business, which has been regarded as a cash cow not only because HOYA has already acquired a high market share but also because there was a period of stagnation in the growth potential of related markets, is also expected to grow due to such factors as the breakthrough in semiconductor miniaturization technology in recent years and the acceleration of the data-driven trend in all industries. Given such circumstances, we will put in place a framework to determine the growth potential on a business-by-business basis and on a product-by-product basis, irrespective of whether the segment is in the Life Care business or the Information Technology business.

We also recognize that the development/acquisition of new businesses that serve as the driving force for perpetual corporate growth is the most significant management challenge, so we will work on this by taking a two-pronged approach, i.e., in-house development and M&A. Given that there have not been many cases in which business divisions collaborated with each other in the past, we will launch research and development across business divisions on a project-by-project basis going forward, in an effort to create new markets and products. Looking ahead, we will also consider M&A—which has been executed mainly in the Life Care business to date—by expanding the scope to include the Information Technology business domain as well, not just Life Care business-related opportunities. Market domains that are presumed to be selected are fields adjacent to existing domains that are consistent with HOYA’s vision and mission; we will seek to enter domains that look promising for HOYA to establish its position as a leader in niche markets and attain high profitability.

Ahead of other Japanese companies, HOYA’s Board of Directors has consisted of independent directors accounting for the majority of its members, and its corporate governance (G) has been enhanced with high objectivity and transparency based on a framework in the form of a system of committees. Going forward, HOYA will accelerate environmental (E) and social (S) initiatives as well.

Please also refer to the message by Ms. Tomoko Nakagawa, Chief Sustainability (ESG) Officer, etc.