HOYA’s ESG Approach

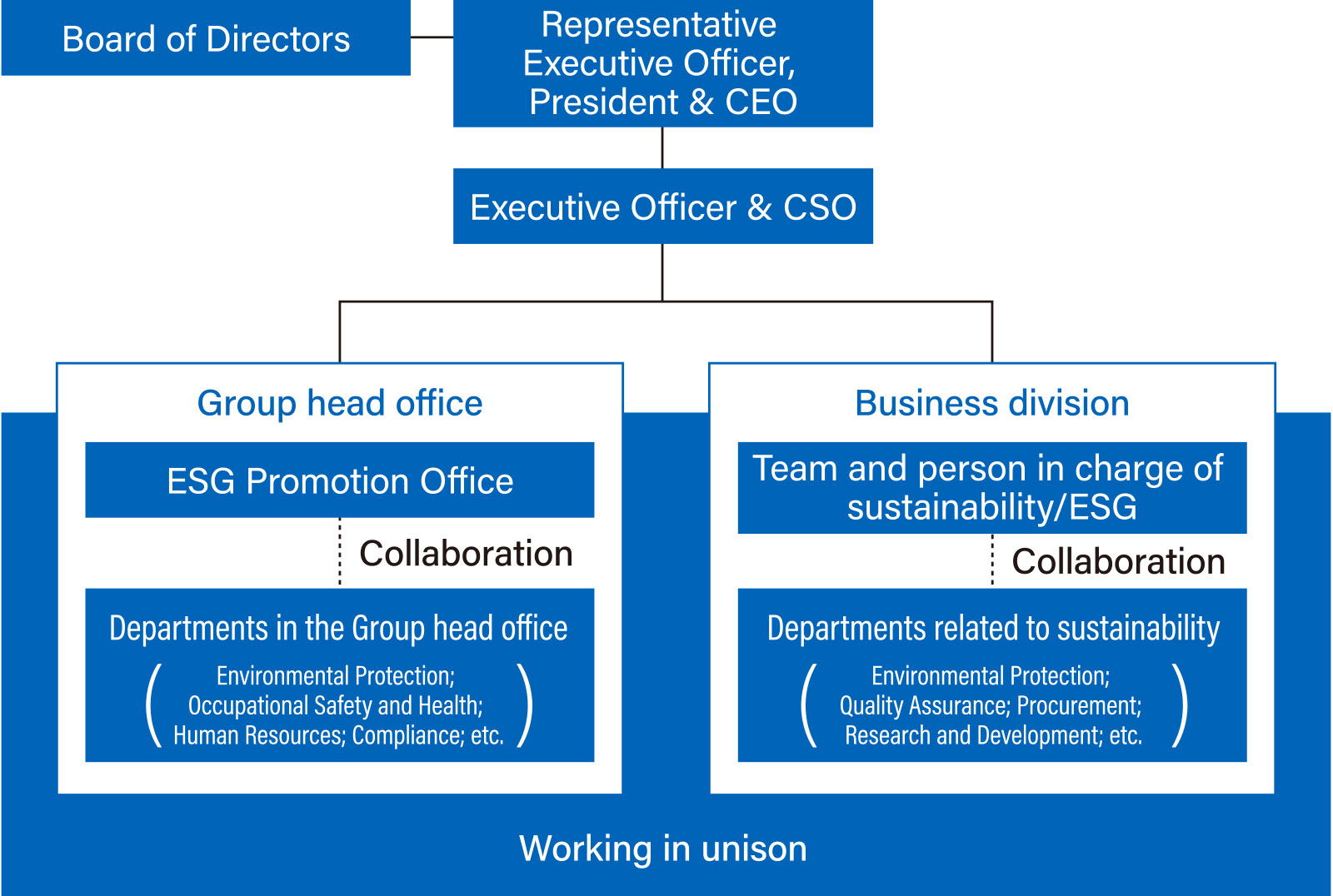

ESG and Sustainability Governance Framework

Governance

HOYA is organized as a company with Nomination Committee, etc. As such, the Board of Directors functions as a monitoring board, supervising the executive side and deliberating and deciding on materialities in management policy Group-wide. To secure management supervisory functions and ensure their objectivity, in fiscal 2024 the Company established a framework in which five of seven directors are outside directors. We appoint outside directors with extensive executive experience and a global perspective, who also possess deep knowledge of sustainability and ESG-related fields, as well as a clear understanding of emerging trends—including climate change, talent development, and leadership development—and practical experience in these areas.

The Group's basic sustainability policies, including climate change countermeasures, materiality, and important measures such as TCFD and RE100 are disclosed through deliberation and decision-making procedures by the Board of Directors. In addition, the Board of Directors receives regular reports on issues related to sustainability, including responses to climate change, from the Chief Sustainability Officer (twice a year in fiscal 2024), and monitors progress. The Board of Directors' receives reports on climate change responses in each business division during business reviews at Board of Directors meetings and provides advice from multiple perspectives. Similarly, the Group CHRO reports regularly to the Board of Directors regarding personnel measures across the HOYA Group, and the Group CCO reports regularly to the Board of Directors on compliance (once a year in fiscal 2024).

At HOYA, we conduct business operations through a divisional management approach facilitated by portfolio management. As such, each business division’s specific policies on responding to sustainability-related issues, including climate change and human capital, are reflected in the management strategy, management plan and annual budget of each business, to be approved and decided by the Board of Directors. Additionally, each business division’s head (division president) appoints a sustainability/ESG team within their division. Under the direction of the division head, the division’s KPIs, aligned with the Group’s goals, are set in consultation with the CSO. The division then implements measures to achieve these established KPIs.

In fiscal 2022, ESG indicators were incorporated into the Performance Share Unit (PSU), serving as a medium- to long-term incentive in executive officers’ remuneration. Targets are set according to evaluations by outside organizations and the status of efforts on key ESG themes, including climate change and human capital. In fiscal 2023, to enhance the effectiveness of these indicators, important KPIs among the key ESG-related targets set by each business division, such as renewable-energy usage rate, were added to the criteria for annual incentives of the presidents of each business division.

Risk management

At the HOYA Group’s head office, we appoint persons responsible for functions considered to pose significant risks, including compliance, pharmaceutical regulations affairs, cybersecurity, and occupational safety and health. Each business division identifies and mitigates risks through the persons responsible for these respective functions.

The responsible persons at the HOYA Group’s head office regularly monitor the activities of the business divisions concerning their respective areas and report to the executive officers on the identification and response status of significant risks. Based on these reports, the overall risk status of the Group is presented to and deliberated by the Board of Directors.

Each business division formulates response policies for significant risks that could have a serious impact on its operations, tailored to its specific business environment and characteristics. Preventive measures for these risks are incorporated into the division’s strategies, business plans, and annual budgets, and are subject to regular oversight by the Board of Directors.

When business division heads present their operations to the Board of Directors, they receive multifaceted questions from outside directors regarding risks specific to their businesses, such as geopolitical and procurement risks. These discussions provide valuable opportunities to deepen risk awareness.

Each business division has an internal audit function that identifies risks through the audit process. In addition, the internal audit department at the Group’s head office develops a risk-based audit plan, which is approved by the Audit Committee. Audits are conducted accordingly, and the results are reported to the Audit Committee. The content of these audits is regularly reported from the Audit Committee to the Board of Directors, thereby ensuring objective risk management through an independent oversight body.

Sustainability/ESG Organizational Structure

Sustainability Policy

For the purpose of clearly stipulating the HOYA Group’s basic stance and policy on sustainability and further promoting sustainability activities, we established the HOYA Group’s Sustainability Policy in May 2022.

HOYA Group is committed to contribute towards building a sustainable society and aims to enhance our long-term corporate value by implementing our management principles based on our corporate mission in our day-to-day work.

We will aim to help resolve global social issues through innovation in our businesses.

We will realize fair and highly transparent corporate management by building a relationship based on trust through consistent dialogue with key stakeholders.

We will aim to minimize environmental externalities in our business activities to ensure our future generations inherit a healthy global environment in future.

We respect the human rights of all people involved in our business activities, including those in our supply chain and will strive to prevent any abuse on human rights.

We will create a work environment to promote diversity and inclusion with an emphasis on the wellbeing of our employees in the aim of keeping high motivation and moral to create new value.

For HOYA’s Corporate Mission, Management Principles and Vision, click here.

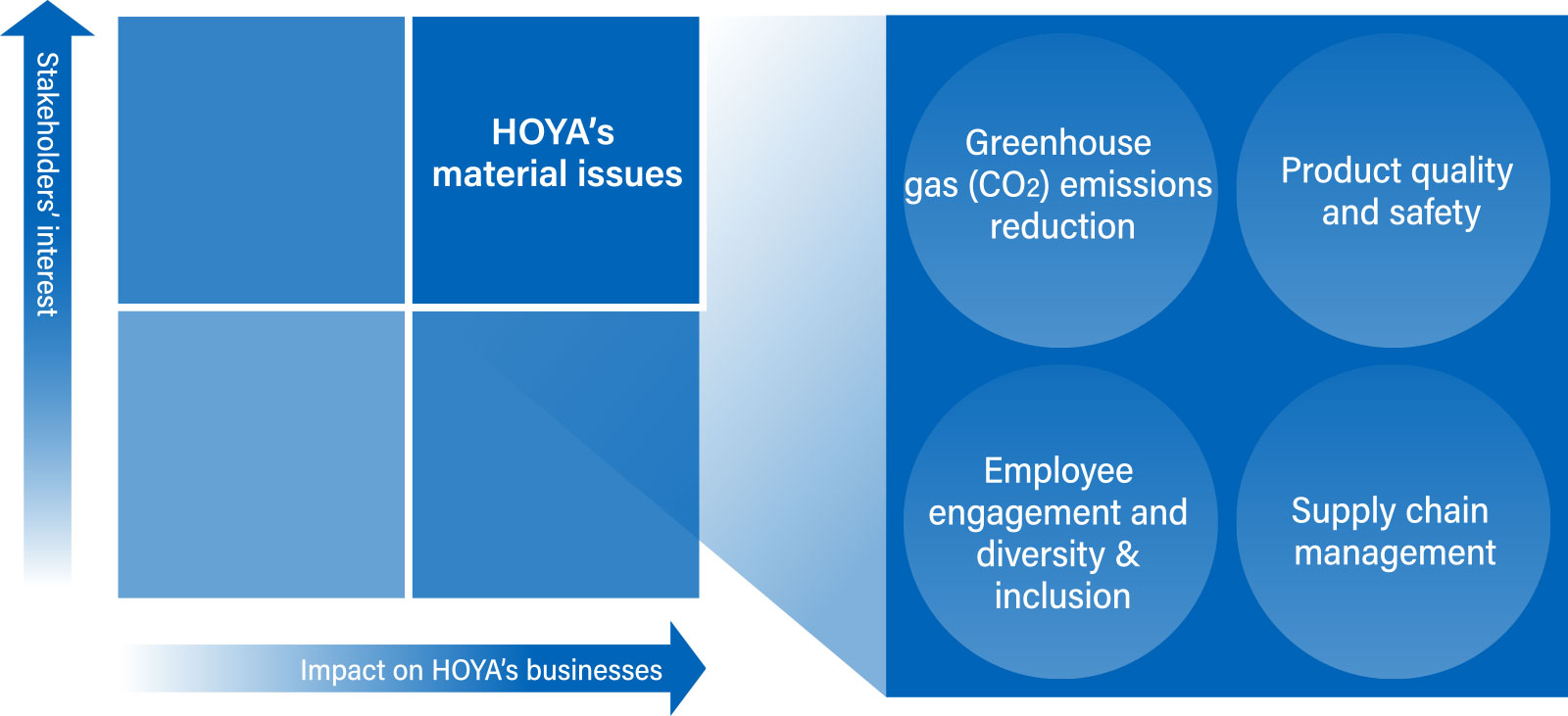

Material Issues

Having internally discussed and examined matters that contribute to the HOYA Group’s medium- to long-term growth (i.e., material issues), we identified four material issues with the approval of the Board of Directors in September 2021. In light of emerging disclosure standards such as the Corporate Sustainability Reporting Directive (CSRD), the International Sustainability Standards Board (ISSB), and the Sustainability Standards Board of Japan (SSBJ), the HOYA Group is currently reviewing its material issues. Going forward, we aim to further enhance the integration and transparency of our sustainability-related disclosures.

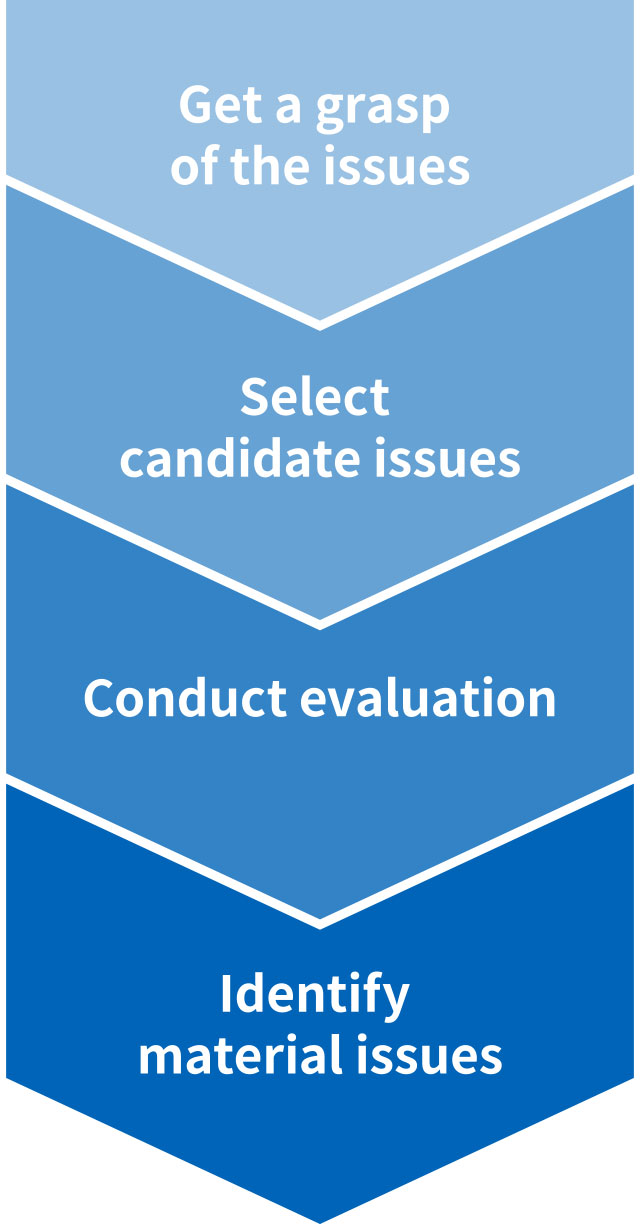

Process of Identifying Material Issues

Get a grasp of changes in society and issues related to HOYA’s businesses.

Analyze ESG rating agencies’ evaluation of HOYA and refer to international guidelines.*1

Interview the management of business divisions.

Use the industry-by-industry Materiality Map*2 by SASB*3 that matches HOYA’s businesses and select the candidate issues based on evaluation on two axes, i.e., by mapping stakeholders’ interest on the vertical axis and the impact on HOYA’s businesses on the horizontal axis.

Conduct an evaluation comprehensively by deepening internal discussions while referring to opinions and feedback obtained from investors in and outside Japan who are key stakeholders.

Obtain approval for the identified four material issues at the Board of Directors’ meeting.

*1. SASB, GRI, IIRC, ISO26000, TCFD, RBA, CDP

*2. Industries: Medical Equipment & Supplies, Hardware, Semiconductors

*3. Sustainability Accounting Standards Board

Identified Material Issues

Four material issues have been identified in HOYA as a result of the above process.

Risks and Opportunities of Material Issues

In consideration of the social issues worldwide and HOYA’s business environment, we examined and discussed the following risks and opportunities in the process of selecting material issues.

Material issue |

Risk |

Opportunity |

|---|---|---|

Greenhouse gas(CO2)emissions reduction |

|

|

Product quality and safety |

|

|

Employee engagement and diversity & inclusion |

|

|

Supply chain management |

|

|

Approach to and Measures for Material Issues

Material issue |

Approach |

Measures |

Relevant SDGs |

|---|---|---|---|

Greenhouse gas(CO2)emissions reduction |

Create a roadmap for achieving the medium- and long-term CO2 emissions reduction target for each business division |

|

|

Product quality and safety |

Review and improve the product safety and quality management system and operations on an ongoing basis—especially in the Life Care business, which deals in medical products—so that customers can use products more effectively and safely |

|

|

Employee engagement and diversity & inclusion |

Aim at creating a workplace environment in which diverse employees can fully demonstrate their capabilities with a sense of fulfillment from work so that employees’ growth also translates into HOYA’s growth |

|

|

Supply chain management |

Properly manage the supply chain based on the HOYA Supplier Code of Conduct, from the viewpoint of complying with laws and regulations and protecting human rights not only internally but also in the supply chain |

|

|