Maximizing Shareholder Value

Advanced corporate governance structure

To ensure the effective functioning and objectivity of the management supervisory function, five out of seven directors are independent outside directors. As a monitoring board, outside directors enhance the quality of corporate governance by applying their wealth of management experience, insight and leadership ability to HOYA’s management.

Independent Director

Hiroaki Yoshihara

Independent Director

Yasuyuki Abe

Independent Director

Takayo Hasegawa

Independent Director

Mika Nishimura

Independent Director

Mototsugu Sato

Eiichiro Ikeda

Ryo Hirooka

Please refer to the website for their biographies and other details.

Skill items |

Definition |

Reason for selection |

Yoshihara |

Abe |

Hasegawa |

Nishimura |

Sato |

|---|---|---|---|---|---|---|---|

Corporate |

Knowledge and experience regarding company management and corresponding corporate governance |

To sustain improvement in business performance and growth, and thereby enhance the corporate value |

● |

● |

● |

● |

|

Global |

Knowledge and experience necessary for global management and relevant business development |

To promote management respecting diverse cultures and customs in each region |

● |

● |

● |

● |

● |

Finance/ |

Knowledge and experience in the finance/accounting domain |

To achieve financial targets and increase transparency to stakeholders |

● |

● |

|||

Related industries/ |

Knowledge and experience regarding industries and businesses associated with the Company’s businesses |

To promote management based on an understanding of industry trends, regulations, and technologies |

● |

● |

● |

● |

|

M&A |

Knowledge and experience in M&A in general, such as due diligence and formulation of integration plans |

To promote the Group’s growth strategy through the implementation of strategic M&A |

● |

● |

● |

● |

|

Sustainability/ |

Knowledge and understanding of trends in the sustainability/ESG area, and relevant experience |

To promote sustainable management to realize a sustainable society, and thereby enhance the corporate value in the medium to long term |

● |

● |

● |

● |

● |

Risk |

Knowledge and experience in the risk management domain, including legal compliance, and supply chain/quality control/IT security |

To continue to provide products and services stably and steadily to the society |

● |

● |

● |

● |

● |

Human resource |

Knowledge and experience regarding the human resources domain, such as cultivation of human resources and leadership development |

To promote management focusing on human capital |

● |

● |

● |

● |

Pursuing capital efficiency

Return to shareholders and capital efficiency are among the key management considerations at HOYA.

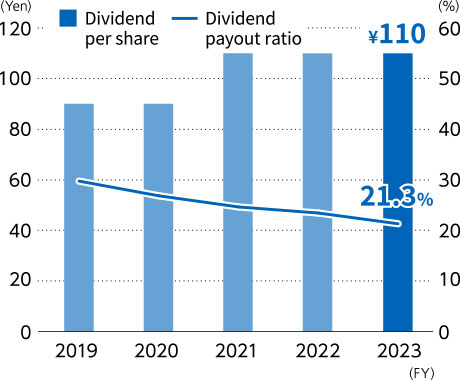

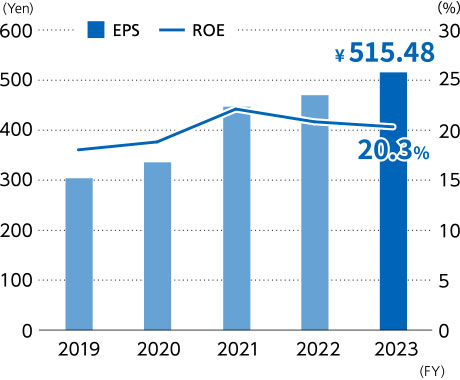

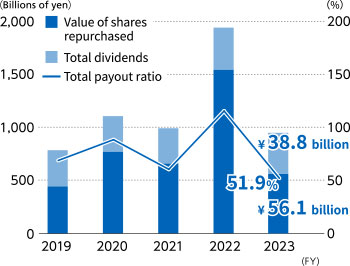

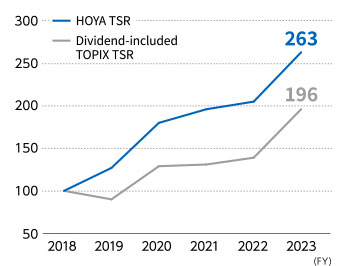

Major management indicators and return to shareholders

Dividend per Share

ROE and EPS

Return of Value to Shareholders

Total Shareholder Return (TSR)

This indicates the investment performance by taking share price changes and dividends into consideration, assuming that an index of 100 equals the amount of investment on March 31, 2019.