Life Care Business

Health Care

Eyeglass Lenses

Market Environment

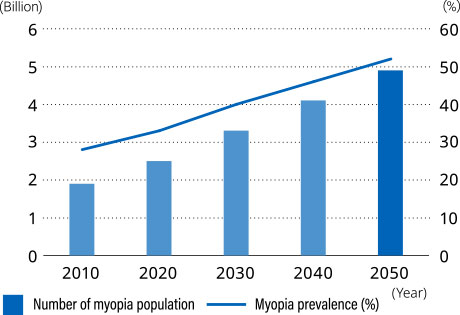

Myopia, or short-sightedness, is a rapidly growing health problem in today’s world, as societies worldwide become more aged, myopia in children increases, and people spend increasing time staring at screens in today’s digital lifestyles. At the same time, awareness of health and wellbeing is growing worldwide. Moreover, economic growth in emerging countries is bringing increased purchasing power to those countries, while awareness of eye health is growing. For all these reasons, the market for eyeglass lenses is expected to enjoy stable growth going forward.

Although the global economic environment remains unclear overall, the market for eyeglass lenses remains relatively immune, owing to their status as necessities and as products covered by private and public health insurance in Western countries.

Number of People with Myopia

Source: Holden, B. A., et al. Global Prevalence of Myopia and High Myopia and Temporal Trends from 2000 through 2050. Ophthalmology. 2016 May; 123(5): 1036~1042

Status of Our Business

Business Overview

The HOYA Group sources from material producers resin and other materials used to make eyeglasses, manufactures lenses, and wholesales them to chain and independent optometrist shops.

At the HOYA Group, our mission is to provide people with lifelong eyecare solutions. Guided by this mission, we provide a diverse array of lenses for people in all stages of life, from general single-vision lenses to progressive (varifocal) lenses for elderly people and spectacle lenses for myopia control in younger children. To provide our customers with the best possible products, we pour efforts into continuous research and development aimed at improving eyeglass functionality, in areas such as optical design, lens coating and photochromatic Lenses*.

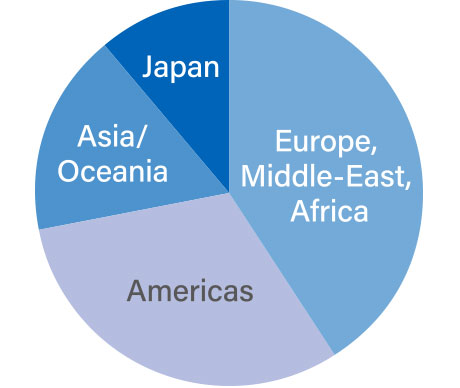

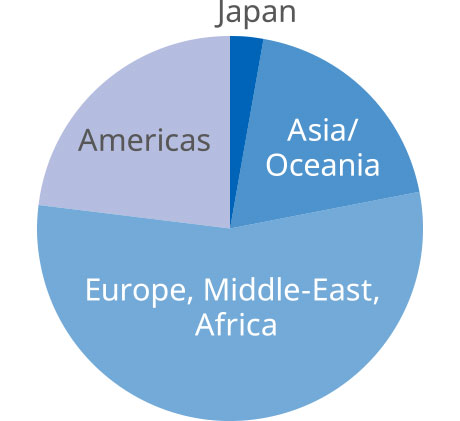

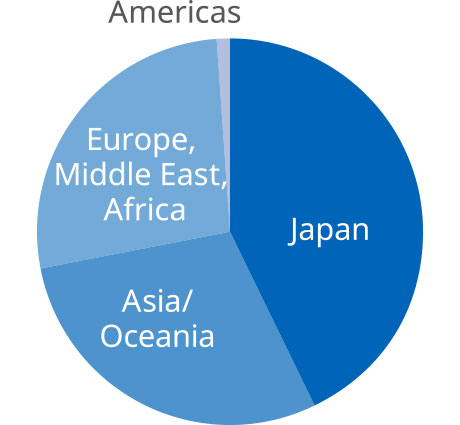

On a regional basis, overseas net sales account for 90% of the total. Sales are greatest in Europe, followed by the Americas. The HOYA Group operates production facilities around the world, with particularly high production volume in Thailand and Vietnam.

* A lens that darkens its color when exposed to UV light

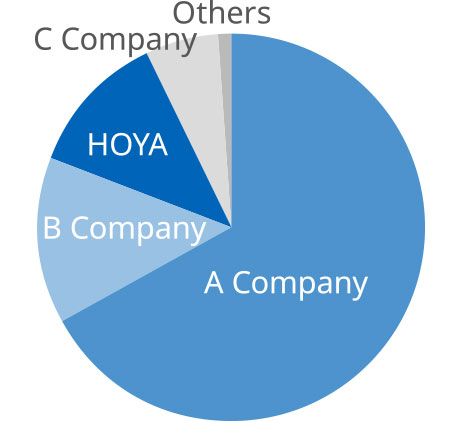

Market Position

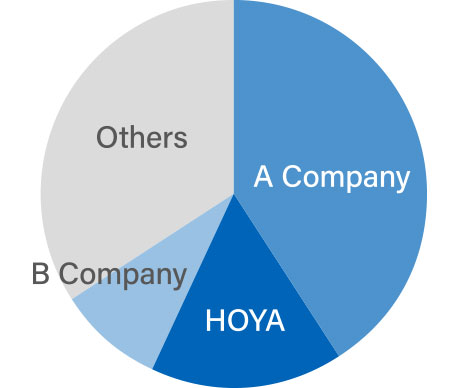

The HOYA Group boasts the world No. 2 spot in eyeglass lenses. In addition to organic growth, we have expanded market share through mergers and acquisitions. A little less than 30% of the share of this market is held by numerous small to medium-sized lens manufacturers. By capturing market share from and acquiring these smaller players, the HOYA Group is continuously striving to grow market share.

Conditions by Region

The market is a mature one, with North America and Europe forming our most important market, accounting for some 70% of divisional sales. Nonetheless, the HOYA Group has plenty of room to grow its market presence in the United States, and we are working hard to reinforce the local organization and sales capability in that country.

Turning to Asia ex-Japan, our growth in China has been spectacular. We are significantly expanding sales in China through MiYOSMART (of which more later).

Outlook

Eyeglass lenses are the HOYA Group’s largest source of sales. They are the driver of the expansion of the Life Care business overall.

The HOYA Group is improving customer experience and cultivating even stronger relationships with optometrist shops and eyecare professionals worldwide. To this end, we are bolstering local lab services in each region and enhancing our global manufacturing footprint and redundancy.

Technological innovation is vital to serve customers’ vision correction needs at each life stage. Among them, remedial solutions to improve eyesight are attracting attention. MiYOSMART is a lens used to slow the progression of myopia in younger children. Since the product’s launch in 2018, over 4 million MiYOSMART lenses have been sold worldwide, with HOYA taking the lead in this product category. Today the HOYA Group sells MiYOSMART lenses in over 30 countries*. Going forward, the Group plans to launch the sunglass and photochromatic versions of MiYOSMART lenses and to roll out MiYOSMART lenses in new markets.

In regional terms, we are strengthening our sales activities in China and other high-growth emerging markets, expanding market share. In the United States, where a high percentage of sales are to independent optometrist shops, we are enhancing our presence in business targeting optometrist chains. To extend our reach to customers, we are also looking into mergers and acquisitions.

By means of these efforts, the HOYA Group aims to achieve higher growth than in the past (low-to-mid single digit).

Market Share

(FY2022)

[HOYA estimate on a value basis]

Sales by Region

(FY2022)

* As of August 2022, MiYOSMART has not received approval in Japan.

For more information, please visit the official MiYOSMART website

Contact Lenses

Market Environment

The retail market for contact lenses in Japan is growing at a gradual 1% or so annually, against a background of declining birthrate and population aging.

In the most recent fiscal year, the COVID-19 pandemic calmed down, increasing opportunities for outings and thereby the frequency with which people put in and take out their contact lenses. The market is growing at a faster pace than usual as a result. The COVID-19 pandemic may have triggered an increase in opportunities to purchase contact lenses via the internet.

Rising myopia among the young, combined with increasing adoption of bifocal contact lenses among the elderly, is boosting demand for contact lenses, particularly for high-value-added products, pushing up the average unit price per sale. The market is expected to continue to grow in this fashion, albeit at a modest pace.

Status of Our Business

Business Overview

Eyecity is HOYA’s contact lens specialty retail store chain, comprising 360 outlets across Japan. Eyecity offers consulting sales, proposing products optimally tailored to each individual customer, backed by a comprehensive lineup of products from major producers worldwide. Outlets are typically situated in convenient locations, such as near train stations and in shopping malls. To cater to today’s growing online shopping needs, HOYA also offers subscription and on-demand delivery services, to enthusiastic customer reception.

In March 2022 HOYA began manufacturing and selling the hoyaONE series of private-brand contact lenses. The Company is pursuing a vertical-integration strategy, leveraging its strengths in retail channels for contact lenses.

Market Position

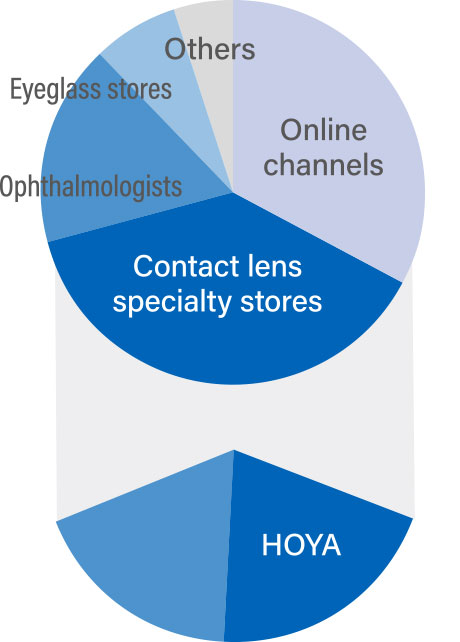

HOYA holds more than 50% of the market share in the largest category of contact lens sales channels, contact lens specialty stores. HOYA expects contact lens specialty stores to continue taking market share from ophthalmological channels, owing to their comprehensive lineups and superior prices.

On the other hand, online shopping has been expanding its market share in recent years. HOYA believes that responding to this channel will be vital in assuring the Company’s market position.

Outlook

The Company has been pursuing a strategy of raising its profile by opening 15 to 20 stores a year. However, as the number of stores operated in Japan has now reached some 360 locations, HOYA is now advancing a change of growth strategy.

HOYA now aims to grow by improving customer retention at existing stores and increasing unit price per customer by offering high-value-added products.

Also, to cater to today’s growing online shopping needs, HOYA is moving to strengthen its online sale services, such as subscription and on-demand delivery services.

We are also focusing on sales of our private-brand, the hoyaONE series, aiming for mid-single-digit growth.

Sales Composition Ratio

by Sales Channel(FY2022)

HOYA Market Share at Contact Lens Specialty Stores

[HOYA estimate on a value basis]

Medical

Medical Endoscopes

Market Environment

Medical expenses are increasing worldwide in line with the aging of society. To keep medical expenses in check, governments in countries across the globe are promoting the early detection of disease and minimally invasive medical procedures. Minimally invasive medical treatment does not involve the use of a scalpel on the patient’s body and thus minimizes the physical burden on the patient. Due to this demand, endoscopes are attracting a great deal of attention.

The growth of the endoscope market is modest in developed countries. In Asia ex-Japan, however, growth rates remain high, as these countries are still in the early adoption phase. China especially is expected to lead growth in the global market.

Status of Our Business

Business Overview

HOYA conducts research & development, manufacturing, and sales of medical flexible endoscopes used in the examination and treatment of digestive system, ear, nose & throat (ENT), respiratory organs, etc. Medical flexible endoscopes are composed of a scope that is inserted into the patient’s body and a video processor. The Company sells these products to healthcare institutions, organizations that purchase jointly with healthcare institutions, and sales agencies.

Market Position

HOYA is the third largest group in the industry globally. The Group’s strengths lie in high image quality; ultrasonic endoscopes; small-diameter endoscopes that strike a balance among image quality, exterior diameter and channel size; and products designed for easy cleaning and disinfection.

Conditions by Region

Most of the Company’s sales are in Europe and other overseas regions.

Outlook

The demographic profiles of many countries are aging. Also, demand is growing for minimally invasive medical procedures. As a result of these factors, the market for medical endoscopes is forecast to grow in the mid-to-high single digit.

In the short term, as a result of the reopening of economies from the COVID-19 pandemic, use of endoscopes by healthcare facilities, and therefore demand from first-time purchases and upgrade purchases of endoscopes, is expected to continue to grow. Also, supplies of electronic components for the video-processing components of these products are gradually increasing, but it will take time for the supply to satisfy demand fully.

Against the background described above, in fiscal 2023 HOYA expects to expand the list of regions in which it sells single-use endoscopes and launch two new products, a high-end video processor and video gastroenteroscope, in various countries.

Market Share (FY2022)

[HOYA estimate on a value basis]

Sales by Region (FY2022)

PENTAX Medical ONE Pulmo

(Single-use bronchial endoscope)

PENTAX Medical INSPIRATM Video Processor EPK-i8020c, i20c series scope

(High-end video processor and video gastrointestinal scope)

Intraocular Lenses

Market Environment

As populations age around the world, medical infrastructure spreads in emerging countries and access to advanced medical technology improves, demand for intraocular lenses for cataracts is rising. Cataracts are a disease in which a cloudy white area forms in the crystalline lens of the eye, causing vision to deteriorate. Probability of suffering cataracts increases with age and is the greatest cause of eyesight loss in the world today. In cataract surgery, the natural lens that has developed the cataract is replaced with a new, clear IOL.

In addition to conventional monofocal lenses, in recent years high-end products such as trifocal lenses and lenses with deep focal depth have entered the market, resulting in mid-single digit market growth.

In the near term, sales growth should be higher than normal in Japan, whose recovery from the effects of the COVID-19 pandemic was delayed compared with other countries.

Status of Our Business

Business Overview

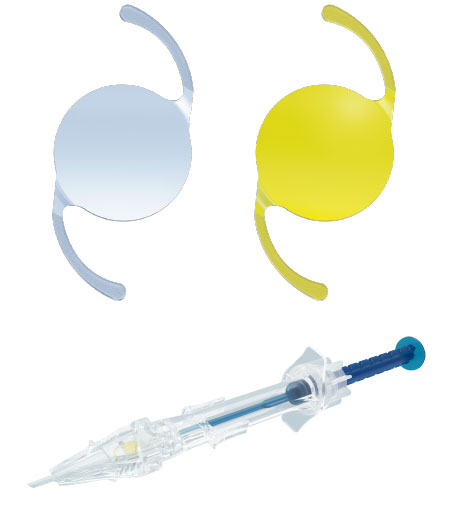

In this field, we perform research and development, manufacturing, and sales of ophthalmic medical devices and intraocular lenses (IOLs) for cataract surgeries.

Drawing on over 30 years of experience and expertise in the IOL business, HOYA has contributed to improving the vision and quality of life of millions of cataract sufferers.

HOYA pre-loaded IOLs* combine HOYA’s strengths in optical technology with the Group’s experience and expertise in developing injectors for intraocular lenses. These advantages have earned admiration on the global market, propelling the HOYA Group to top market share in this category.

* In a pre-loaded injector, the intraocular lens is pre-installed in the injector, supporting safer and more reliable surgeries.

Vivinex

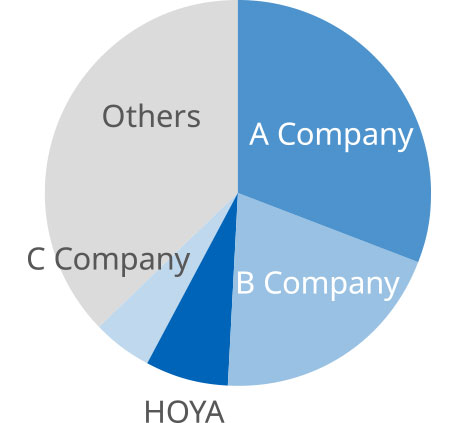

Market Position

HOYA is steadily increasing its market share and currently holds the global No. 3 position.

Driven by the flagship brand, VivinexTM (launched in 2015), sales continue to grow at a pace that is above the market. VivinexTM combines an IOL material that offers unprecedented clarity of vision with multiSertTM, our proprietary 4-in-1 injector, which is designed to provide outstanding IOL delivery consistency.

Status by Region

In a breakdown of net sales by region, Japan accounts for about 40% of HOYA’s worldwide net sales.

HOYA is continually expanding the roster of countries in which it sells. As a result, our overseas sales ratio is expected to rise.

Outlook

By bolstering sales of Vivinex Gemetric trifocal IOLs, a high-value-added product, HOYA is meeting the needs and expectations of a wider range of customers.

In addition to bolstering our sales workforce in regions in which we already have sales bases, we are establishing sales companies and reaching out to sales agencies in regions in which we do not yet have a presence. In this way we are widening our total addressable market. In January 2023 the HOYA Group established a sales company in South Korea, a country where demand for IOLs is rising.

As a result of the above initiatives, the HOYA Group is aiming to outgrow the IOL market overall (mid-single-digit).

Market Share (FY2022)

[HOYA estimate on a value basis]

Sales Composition of HOYA Surgical Optics by Region (FY2022)

Ceramic Artificial Bones, Metal Orthopedic Implants

Market Environment

As Japan’s demographic profile ages, bone fractures and disease are on the rise. The market for orthopedic and neurosurgical implants effective in their treatment is expected to continue to grow.

Status of Our Business

Business Overview

HOYA develops and manufactures ceramic artificial bones and metal implants, which are used to compensate for bone loss and repair bone fractures. The Company mainly supplies these products to healthcare facilities in Japan, where they contribute to the treatment of numerous patients.

Market Position

In the ceramics market, HOYA was the first company in Japan to manufacture and sell a hydroxyapatite product with more or less the same constituents as a human bone, and has led the Japanese market ever since. HOYA entered the market of metal implants in 2012, through management integration with Japan Universal Technologies, Inc. We manufacture and sell implants that are optimized to the skeletal structure of Japanese people in terms of shape and size. In metal orthopedic implants for distal radius fractures, HOYA offers an extensive product lineup that has captured top market share in Japan (HOYA survey, case basis).

Outlook

By maintaining its share of the ceramic artificial bone market and developing new applications, the Company expects to expand its market. HOYA will respond to patient and healthcare-facility needs by extending its lineup of metal implant products and bolstering its sales capabilities. Leveraging its strength as both a manufacturer and vendor of both ceramic artificial bone and metal implants, HOYA aims to combine products of both materials to propose new surgical procedures, thereby differentiating itself from the competitors.

Bioactive ceramic implant BIOPEX

Metal orthopedic implant HTS Stellar D for distal radius fractures

Chromatography Media

Market Environment

The market of separation/purification media (chromatography media) used in the development and production of biopharmaceutical products is expected to grow at a rate of over 10% globally in the years ahead, due to the expansion of the biopharmaceuticals market.

Status of Our Business

Business Overview

The Company manufactures bioceramic chromatography media and sells them through distributors. The products are adopted by pharmaceutical companies and research facilities worldwide.

Market Position

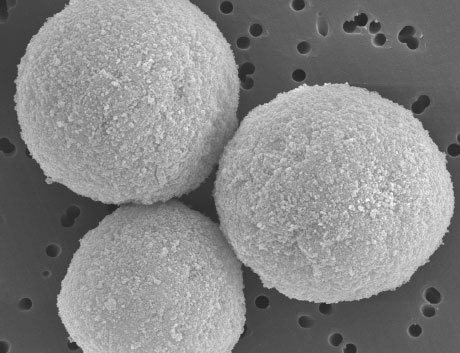

A wide range of methods are used to separate and refine biopharmaceuticals. HOYA’s spherical ceramic hydroxyapatite media possess high capacity for absorption of various proteins, enabling efficient removal and powerful separation of impurities in the purification process. As such, these unique products enjoy strong market favor.

Outlook

Market needs for biopharmaceuticals are many and diverse, extending to antibody preparations, vaccines, gene therapies and more. To cater to these needs and secure further growth, the HOYA Group is working with customers and research institutes to accelerate the development of products and refining processes and is expanding production capacity to respond to growing demand.

Chromatography media

(enlarged image)