Information Technology Business

Electronics

Mask Blanks for Semiconductors

Market Environment

Although prone to business cycles, the semiconductor market is forecast to continue growing for the long term, in tandem with the continuing development of technologies such as cloud computing, AI, IoT and automated driving. To fabricate ever more high-density, high-performance semiconductors, miniaturization of circuit patterns is progressing. For example, the introduction of lithography technologies using extreme ultraviolet (EUV) light is expanding.

Over the short term, the semiconductor market, which had been active during the COVID-19 pandemic, began to deteriorate from about mid-2022. More recently, however, investment in semiconductors related to generative AI (GPUs, etc.) has grown active. Taking market cycles into consideration, a recovery in this field is anticipated from 2024 onward.

Status of Our Business

Business Overview

In this business, we perform research, development, and manufacturing of mask blanks for semiconductors and sell these products to semiconductor manufacturers and foundries as well as mask shops.

Critical in the semiconductor fabrication process, photomasks are the master plates used to transfer a semiconductor’s intricate and complex circuit pattern onto a semiconductor wafer, and mask blanks are the base material used for photomask manufacturing.

Because mask blanks are created for each individual circuit pattern, they are essential to product development by semiconductor manufacturers, foundries, and other HOYA customers, and in the R&D stage of miniaturization.

Market Position

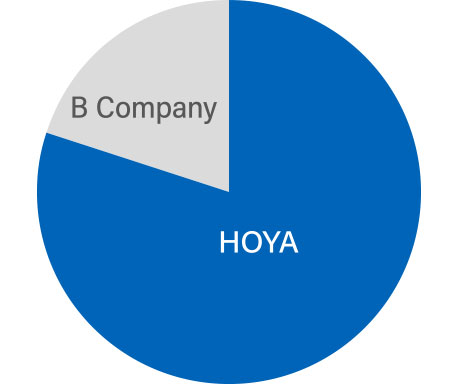

In close collaboration with its customers, HOYA has long contributed to the miniaturization and improvement of performance of semiconductors. This track record has enabled the Company to maintain an exceptionally large share of the market for mask blanks for many years.

Competition in the field of EUV mask blanks is expected to intensify over the medium to long term. HOYA expects to continue to lead the field, leveraging its preeminence in low-defect products and next-generation products such as phase shift masks.

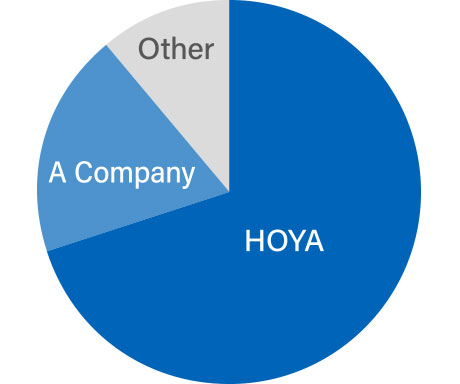

HOYA consistently maintains a strong presence in optical deep-ultraviolet (DUV) lithography, a conventional lithographic technology.

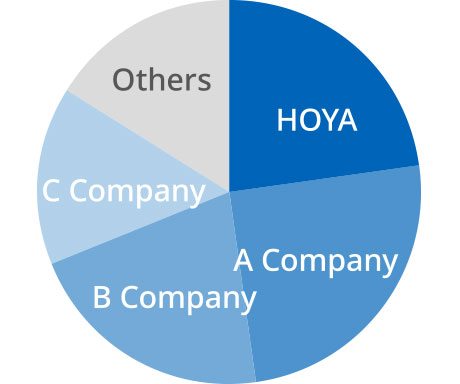

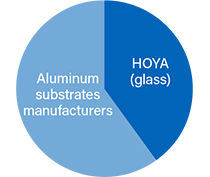

Market Share (EUV)

(FY2022)

Outlook

Demand for EUV mask blanks is expected to continue to grow over the long term.

Mask blanks are used in R&D activities in significant quantities, but they are not consumables, so demand for them related to the mass production phase is comparatively light. For this reason, demand for mask blanks is only weakly correlated with demand for final products in the semiconductor market. As such, growth for these products derives from the continuing miniaturization of circuit channels and the number of designs for final products.

As of 2023, mass production of semiconductors of the 3 nm generation using EUV lithography has begun. Nodes will continue to shrink every two to three years, to 2 nm, then 1.4 nm and so on. In tandem with this miniaturization, customer demands for quality (fewer defects, etc.) will become increasingly challenging, leading to demand for mask blanks suited to phase shift masks and high-numerical-aperture (high-NA) EUV lithography.

Under these conditions, the Company is introducing leading-edge equipment and continuously strengthening production capacity. At the beginning of 2023, HOYA boosted the production capacity of its EUV mask-blank plant in Singapore and placed orders for additional EUV mask-blank inspection equipment. HOYA is vigorously investing in growth.

Market Share (Optical)

(FY2022)

[HOYA estimate on a value basis]

Photomasks for FPDs

Market Environment

Flat panel displays (FPDs) are used in a wide array of products, including TVs, PCs, smartphones, and automobiles.

For many years, LCDs were the focus of display technology. In recent years, adoption of organic light emitting diode (OLEDs) has advanced, principally in smartphones and high-end TVs.

Under the environment described above, photomasks for FPDs have continued to enjoy solid demand, as LCDs have given way to OLEDs and new functions and designs, such as flexible OLEDs that enables bendable displays, have been developed. In regional terms, manufacturers in China have set the pace on growth in this segment.

Status of Our Business

Business Overview

When manufacturing FPDs for TVs, smartphones, laptop computers, and other devices, photomasks for FPD manufacturing are important components used as the master plates to transfer the circuit pattern onto the substrate.

HOYA sources the substrate from raw materials manufacturers, and on that substrate performs polishing, deposition, and resist applications (blanks manufacturing). When the manufacture of the blanks is completed, HOYA conducts circuit pattern drawing, developing, etching, and resist stripping and cleaning, and delivers it to panel manufacturers (photomask manufacturing).

HOYA Position and Market Share

HOYA possesses expertise in high-precision products such as high-resolution masks and phase-shifting masks, and holds the top-class market share.

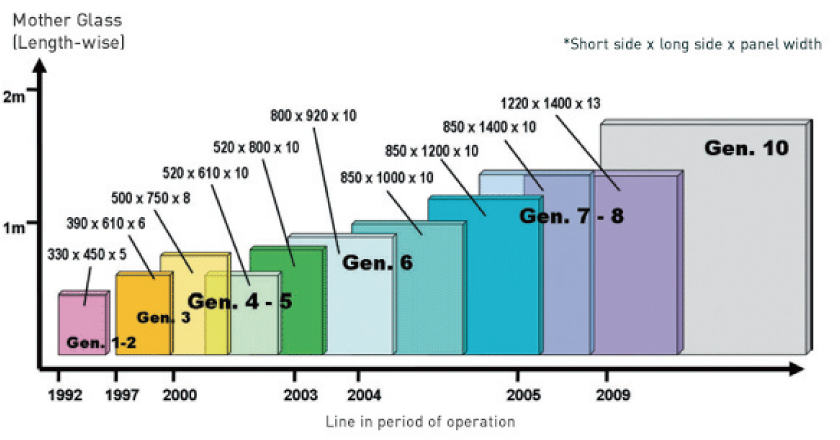

FPDs are categorized by generation, which corresponds to mother glass size. Our business focuses on medium-sized mother glass of generations 6 to 8.

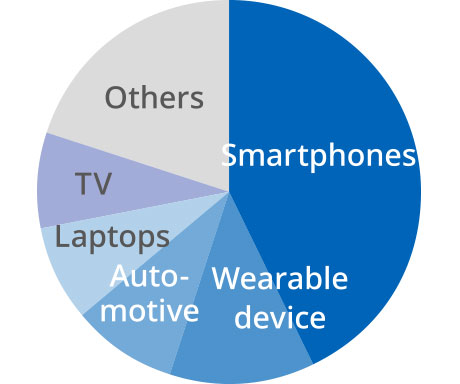

Sales Composition by Application

The ratio of sales by application is shown in the pie graph at right.

Smartphones account for the largest share. However, sales for new applications, such as wearable devices and automotive applications, are growing.

Market Share (FY2022)

Sales Composition by Application (FY2022)

Outlook

HOYA aims to achieve steady business growth by focusing on high-precision products of medium size (generations 6 to 8), which are expected to continue to grow.

To capture demand from panel manufacturers in China, which are enjoying blistering growth, in September 2022, HOYA established a joint-venture company with BOE Group, the world’s largest panel manufacturer. This joint-venture company, Chongqing MasTek Electronics Co., Ltd., is constructing an FPD photomask plant in Chongqing. Completion is expected at the beginning of 2024.

Ground-breaking ceremony at the plant of Chongqing MasTek Electronics Co., Ltd.

Glass Substrates for HDDs

Market Environment

The market for hard disk drives (HDDs) is expected to enjoy stable demand over the medium to long term as demand for data storage consistently grows. Fields such as cloud services and data centers depend critically on large-volume, low-cost data storage. HDDs provide high capacity and can store large volumes of data at relatively low cost, so they are widely used for nearline* applications. As data generation volume grows, demand for HDDs is expected to grow continuously over the long term.

In consumer products such as laptop PCs and game devices, however, solid state drives (SSDs) are steadily replacing HDDs, owing to their superiority in high-speed data access, impact-resistance, and low power consumption.

In the short term, the HDD market enjoyed special demand due to the COVID-19 pandemic, as people chose or were compelled to work from home. However, as historic inflation has hampered personal-consumption expenditures and corporate investments, the near-term prospects of HDDs are uncertain.

*Nearline data storage is not as fast as online storage, but it can be accessed over a network if necessary, unlike magnetic tape and other offline storage approaches, so it is a data storage solution capable of high-speed data communication.

Status of Our Business

Business Overview

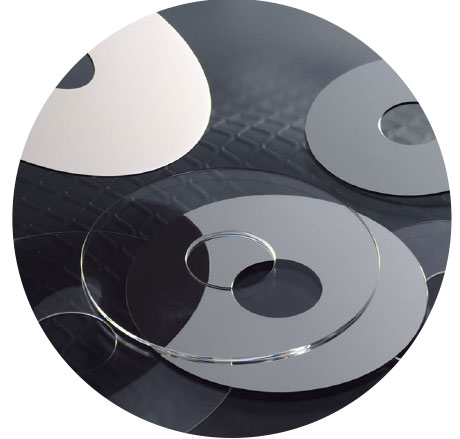

In this area, HOYA conducts research and development, manufacturing, and sales of glass substrates for HDDs. From raw material manufacturers, HOYA sources substrate raw materials, which the Company processes into disc shapes, strengthens and polishes. After processing, we sell this substrate to HDD manufacturers and to media manufacturers who turn it into magnetic media.

HOYA manufactures 3.5-inch-standard products for nearline servers and 2.5-inch-standard products for laptop PCs and other consumer products. Today the majority of sales are in 3.5-inch-standard products.

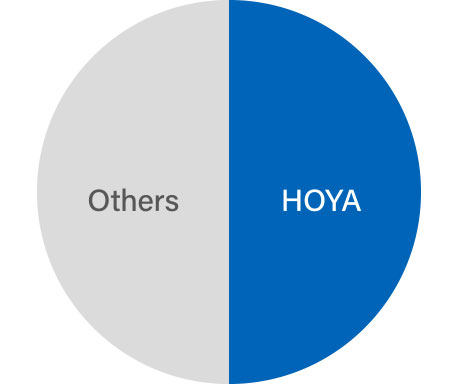

HOYA Position and Market Share

HOYA is the world’s only glass substrate manufacturer, commanding 100% market share.

The market for substrates for consumer products (2.5 inches) consists entirely of glass products, which is one reason HOYA holds 100% share of this market.

The market for substrates for nearline applications (3.5 inches) includes both aluminum and glass products. We estimate that HOYA’s share of this market is about 40%. As ballooning data generation volumes stoke demand for high-capacity HDDs, next-generation technologies such as heat-assisted magnetic recording (HAMR) are expected to be introduced and increasing number of disks (11 or more) are expected to be mounted in some products. Each of these solutions requires glass substrates, so HOYA expects to extend its share of the data-center market.

3.5-Inch Substrate Used for Near Line Servers Market Share (FY2022)

[HOYA estimate on a value volume basis]

Outlook

Demand for 3.5-inch products for nearline applications is slackening in the short term amid a global economic slowdown. In the long term, however, sustainable long-term growth is foreseen thanks to expanding use of online services such as video streaming, social media, and e-commerce, as well as DX, cloud services, and generative AI. The superiority of glass substrates in handling high-capacity data-storage applications is expected to boost HOYA’s market share long term.

2.5-inch products for consumer products are expected to be gradually replaced by SSDs. Sales volume on these products is already small, so HOYA believes their impact on the glass substrate business as a whole is limited.

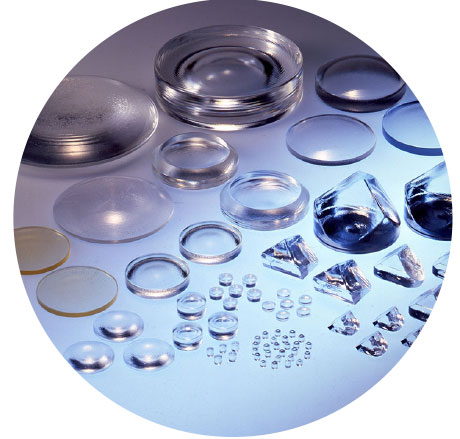

Imaging

Imaging-related Products (Including optical glass, optical lenses, camera lens units, and lasers)

Market Environment

The digital-camera market is trending favorably, lifted by the reopening of economies after COVID-19 and active development by camera manufacturers of mirrorless cameras and their interchangeable lenses. The market for cameras used in automotive systems such as driver-assist systems, collision-avoidance systems, and parking-assist systems is continuing to grow, and further growth is forecast in fields related to automated driving systems.

Status of Our Business

Business Overview

In this area, we conduct research and development, manufacturing, and sales of optical lenses for a variety of cameras, as well as for optical glass materials. These products are used in a wide variety of applications, including automotive cameras and interchangeable lenses for mirrorless cameras. HOYA sources materials from optical glass material manufacturers, conducts compound and solution treatments, manufactures lens materials and lens products, and sells to lens and camera manufacturers.

Market Position

HOYA is engaged in the entire sequence of operations from R&D on optical glass composition to manufacturing of finished products of lenses. We have built out a system fully capable of multi-model, large-volume production.

HOYA boasts strengths in aspherical glass molded lenses (GMOs), supporting high market share.

GMOs are optical lens products that are molded by direct pressing of optical glass that has been rendered flexible in high heat, without polishing. Because they deliver excellent aberration correction, GMOs enable the number of lenses used in optical systems to be reduced, contributing to smaller size, lower weight and more advanced function of the cameras that are the final products.

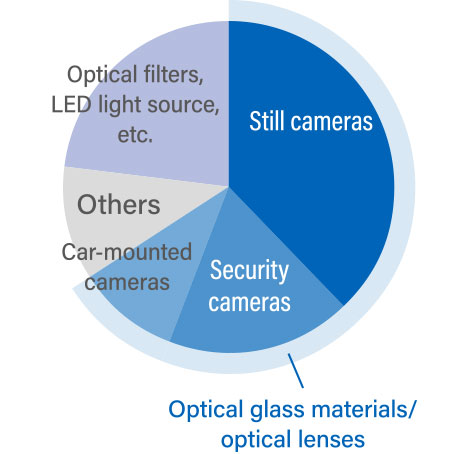

Sales Composition by Application

Interchangeable lenses for mirrorless cameras and still cameras such as compact digital cameras account for some 40% of HOYA’s sales in this field. Relatively new applications such as security cameras and automotive cameras are growing as a percentage of sales.

Outlook

While sales of products for still cameras are currently firm, the market is expected to dwindle gradually over the medium to long term as the features and resolution of smartphone cameras expand and improve. In automotive camera products, applications for advanced driver-assistance systems (ADAS) are expected to broaden. Meanwhile the discovery of new applications, such as optical products for augmented reality/mixed reality, is continuously advancing.

Share of Aspherical GMO lenses

(Digital Camera-Related)

(FY2022)

[HOYA estimate on a value basis]

Sales Composition by Application (FY2022)