Environmental

Climate Change

Response to Climate Change

In 2021, the HOYA Group identified four material issues. Among these, the entire Group is tackling “reduction of greenhouse gases” as a top-priority issue. In December 2021, the Group endorsed the Task Force on Climate-related Financial Disclosures (TCFD). Pursuant to this announcement, in April 2023, the Group began disclosing information based on the TCFD Declaration, strengthening its response to risks associated with climate change. In February 2023, the Group joined RE100, an international environmental initiative aimed at achieving 100% sourcing of renewable energy for all energy consumed in business activities. The HOYA Group aims to reach this milestone by fiscal 2040 and is accelerating its efforts toward that end.

Medium- to Long-term Targets and Results

Over 90% of the HOYA Group’s greenhouse-gas emissions (total of Scope 1 and Scope 2) are in Scope 2; the majority of these are indirect emissions arising from purchased electrical power. By aggressively advancing the transition to electricity from renewable sources that do not emit greenhouse gases, the Group is effectively slashing CO2 emissions. The Group is targeting complete transition to renewables (renewable-energy usage rate of 100%) by fiscal 2040, with an interim target of 60% renewable-energy usage rate by fiscal 2030.

Indicator |

FY2021 Result*1 |

FY2022 Result |

FY2030 Target |

FY2040 Target |

|---|---|---|---|---|

Renewable-energy usage rate (%) |

1% |

2% |

60% |

100% |

HOYA Group CO2 emissions |

522K t-CO2 |

499K t-CO2 |

60% reduction |

100% elimination |

*1 Greenhouse gas emissions (Scopes 1 and 2, energy consumption) in FY2021 were verified by a third party through limited-assurance operations. In the course of the verification process, the method of calculation and coefficient used to calculate CO2 were revised, resulting in correction of the figures disclosed in February 2023. The Group expects to receive third-party verification of the FY2022 results within the current year.

For data on Scope 1 and Scope 2 results, please refer to the Environment page of the ESG Databook.

Introduction of Renewable Energy

The HOYA Group is moving forward with switching to renewable energy at each production base and sales base. In fiscal 2022 the Group introduced solar-power generation facility on its own premises, building the facility at HOYA Optical Technology (Weihai) Co., Ltd., a production base for optical glass and lenses in Shandong Province, China. The Group is also accelerating conversion to purchase of renewable energy by reviewing electrical-power agreements and using energy attribute certificates, focusing on countries in which renewables are readily available. In fiscal 2022, based on a renewable-energy plan (with energy attribute certificates) to achieve 100% renewable-energy sourcing at HOYA CORPORATION’s Vision Care Matsushima Plant and at HOYA Lens Deutschland GmbH. In addition, the global head office in Japan has already achieved 100% renewable-energy usage, by means of a feed-in-tariff (FIT) non-fossil-fuel certificate from FIT.

Solar panels installed at HOYA Optical Technology (Weihai) Co., Ltd. (annual generating capacity: 1,300 MWh; reduction in annual CO2 emissions: about 800 t-CO2)

Energy saving and power saving activities

At production bases, we are replacing facilities with energy-saving types (such as adopting ice thermal storage systems and high-efficiency transformers), conducting energy-saving activities (such as optimizing the operating hours of boilers and air-conditioning equipment) and promoting roof-greening, etc. We are also endeavoring to suppress CO2 emissions from non-production bases by such means as introducing casual wear, adjusting the indoor temperature appropriately and implementing efficient lighting in offices.

Examples of energy/power saving initiatives

Use of the Joint Crediting Mechanism (JCM)

-

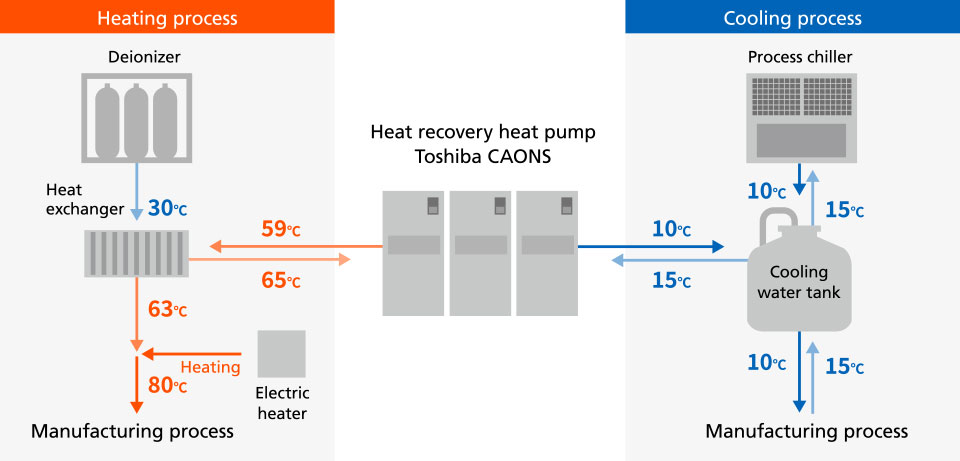

In 2016, we introduced a heat recovery heat pump at the eyeglass lens plant in Vietnam. It is used to save energy and reduce CO2 emissions by using the heat that used to be expelled to the outside air when cold heat was supplied as a source of cold heat for the production process and as an auxiliary heat source for heating the water used in the manufacturing process. Before introducing the heat recovery heat pump, we used only electric heaters to obtain the desired temperature.

At the eyeglass lens plant in Vietnam, one of the existing centrifugal chillers was replaced with a highly efficient inverter centrifugal chiller. By using the new chiller for regular operation and the old one as backup equipment, we achieved a lower introduction cost, improved energy efficiency, and reduced CO2 emissions at the same time.

Scenario Analysis Based on the TCFD Declaration

In fiscal 2022, the Group carried out its first scenario analysis based on the TCFD recommendations. The HOYA Group focused on plants in Thailand and Vietnam that are its main production sites for two business divisions, eyeglass lenses and glass substrates for HDDs, as these operations have high CO2 emissions (high power consumption). Two scenarios were drawn up with fiscal 2030 as the middle of the timeline: one in which global temperatures increase by 4°C, another in which they increase by 1.5°C. In the Group’s analysis of risks and opportunities, personnel from the Executive Office and the division-related segments (Technology Development, Manufacturing, Administration, Sales, and Environment, Safety & Health) conducted workshops with members in Japan, Southeast Asia and Europe. A vigorous exchange of opinions was held, as members shared views based on specialized knowledge, obtaining unvarnished feedback from each workplace. The HOYA Group will continue to conduct regular reviews, responding to events such as business-division expansion and changes in the external environment, reflecting the results of scenario analysis in its business activities and advancing responses to risks and opportunities. In this way the Group will enhance its resilience to climate change.

For details, please refer to “TCFD Disclosure.”

(1) Governance

HOYA is organized as a company with Nomination Committee, etc. As such, the Board of Directors functions as a monitoring board, supervising the executive side and deliberating and deciding on material issues in management policy Group-wide. To secure management supervisory functions and ensure their objectivity, in fiscal 2022 the Company established a framework in which six of eight directors are independent outside directors. All outside directors are fully experienced as managers and possess an international outlook, while several have experience in key management decision-making regarding climate change.

The ESG Promotion Office, a dedicated department at Group head office, proposes activities related to sustainability, including climate change. The Board of Directors deliberates on these proposed measures and decides whether to adopt them. In addition, the Board of Directors receives regular reports from the Chief Sustainability (ESG) Officer (four times in fiscal 2022), on which basis it provides the Company with advice from multifaceted perspectives. In fiscal 2022, the ESG Promotion Office deliberated on and decided a number of matters related to climate change, such as setting the Basic Policy on Sustainability, start of scenario analysis based on TCFD and joining RE100.

At HOYA, we conduct business operations through a divisional management approach facilitated by portfolio management. As such, each business division’s specific policies on responding to sustainability-related issues such as climate change are reflected in the management strategy, management plan and annual budget of each business division, to be approved and decided by the Board of Directors.

Each business division confers with the CSO to set targets and KPIs for that business division in line with Group targets. The CSO reports the activities and progress of each business division to the Board of Directors, which monitors said activities and progress. Beginning in fiscal 2022, ESG indicators are incorporated into the Performance Share Unit (PSU), serving as a medium- to long-term incentive in Executive Officer’s remuneration. Targets are set according to evaluations by outside organizations and the status of efforts on key ESG themes. From fiscal 2023, to enhance the effectiveness of these indicators, important KPIs among the ESG-related targets set by each business division, such as renewable-energy usage rate, were added to the criteria for annual incentives of the presidents of each business division.

(2) Strategy

Dedicated organizations such as the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA) have hypothesized scenarios in which the global average temperature rises by 1.5°C or 4°C by a certain date. Based on these scenarios, the HOYA Group analyzed three aspects—Transition risks, physical risks and opportunities—and assigned each risk and opportunity to one of three levels of importance according to likelihood of occurrence and anticipated financial impact.

Examples of risks and opportunities in the eyeglass lenses business division (excerpt from moderate or higher risks)

Description |

Response |

|

|---|---|---|

Transition risks |

・Delays in responding to consumers’ heightened awareness of climate change results in lost market share and/or declining sales. ・Action on climate change and climate-related disclosure have been added to factors customers use to select suppliers. Delay in responding results in lost customers and/or declining sales. ・Inadequate response to environmental issues such as reduction of CO2 emissions and water recycling causes loss of reputation and/or declining sales. |

・Consideration of listing CO2 emissions on product packaging ・Revision of marketing strategy: Reduction of impact from climate change through product innovation; enhanced dissemination of information ・Regular reporting to customers and other external stakeholders regarding progress on ESG ・Expansion of disclosure related to climate change, such as TCFD or the Carbon Disclosure Project (CDP) |

Physical risks |

Infectious-disease outbreaks made possible by unusual weather disrupt production activities and supply chains or trigger lockdowns and other restrictions on activity, causing the optometrist shops that are the Group’s customers to restrict hours of operation, thereby reducing demand. |

・Drafting and updating of BCPs for Group plants ・Geographical diversification of production sites |

Unusual weather causes stagnation in production or sales activities; flooding causes inundation or destruction of production sites. |

・Geographical diversification of production sites and advancement of measures against water damage ・Drafting of BCPs to secure/safeguard materials, inventories, etc. |

|

Opportunities |

As demand for low-carbon products grows, early success in product development leads to increased sales. |

・Listing of carbon footprints ・Incorporation of determination to reduce environmental impact into product development strategy ・Coordination with material producers |

As demand grows for products that are easy to recycle/reuse, early success in product development leads to increased sales. |

・Formation of a product strategy focused on a recycling-oriented society through collaboration with suppliers and customers |

|

The Group streamlines production processes using DX, etc. |

・Reduction of CO2 emissions and related costs by improving production efficiency ・Investment in DX and DX training |

|

Drafting of BCPs, use of in-house production sites and diversification of suppliers |

・Introduction of and training in BCPs ・Refurbishment of each plant, geographical diversification of production sites, etc. |

Examples of risks and opportunities in the glass substrate for HDDs business division (excerpt from moderate or higher risks)

Description |

Response |

|

|---|---|---|

Physical risks |

Infectious-disease outbreaks made possible by unusual weather disrupt production activities and supply chains, causing customers’ plants to reduce levels of operation, thereby reducing demand. |

・Drafting and updating of BCPs for in-house production sites ・Geographical diversification of production sites ・Consideration of plans to reduce customers’ climate-change risk |

Opportunities |

Disclosures on ESG, climate change, etc. boost the Company’s reputation on financial markets, reducing cost of fundraising. |

・Deployment in disclosures for TCFD and on ESG ・Disclosure and improvement of rank on CDP |

As demand for low-carbon products grows, early success in product development leads to increased sales. |

・Listing of carbon footprints ・Revision of product strategies ・Increase in budget for technology development ・Coordination with material producers |

|

As global warming causes water shortages, successful development of technologies to reuse and reduce water use leads to reduced water costs. |

・Establishment of production methods that use little water ・Introduction of advanced water treatment technologies, increase in reuse |

|

Technologies such as DX achieve improved efficiency in manufacturing processes. |

・Reduction of CO2 emissions and reduction of related costs due to improved production efficiency ・Investment in DX and DX training |

|

Drafting of BCPs, use of in-house production sites and diversification of suppliers |

・Introduction of and training in BCPs ・Refurbishment of each plant, geographical diversification of production sites, etc. |

(3) Risk Management

The HOYA Group continually monitors conditions related to climate change. If conditions change significantly, the head office TCFD Project, which includes members of the ESG Promotion Office, the Corporate Communication Department and the Environmental Safety and Health Department, works with business divisions to review risks. Under the general supervision of the persons responsible for each business, the appropriate segments of each business division (Production Division, Retail Development Department, Purchasing Department, etc.) coordinate and conduct their responses.

With respect to risk related to changes in the operating environment due to climate change (transition risks), based on scenario analysis, the sustainability/ESG teams and persons responsible in the business divisions in each country work with segments related to sustainability, such as environmental, quality-assurance, purchasing and other segments, to draft and implement responses appropriate to their respective business divisions.

(4) Indicators and Targets

Indicators used to evaluate climate-related risks and opportunities include Scope 1 and Scope 2 greenhouse gas emissions and share of renewables in energy used in business activities.

Targets for introduction of renewable energy

・Transition to 60% of electricity used in business activities to renewable energy sources by fiscal 2030

・Transition to 100% of electricity used in business activities to renewable energy sources by fiscal 2040

CO2 emission reduction targets (Scope 1 and Scope 2)

・60% reduction of CO2 emissions by fiscal 2030 (compared with fiscal 2021)

・100% elimination of CO2 emissions by fiscal 2040 (compared with fiscal 2021)

Biodiversity

The HOYA Group works actively to support and protect biodiversity. Based on the HOYA Group Environmental Philosophy and Fundamental Environmental Policies, the Group scrupulously conducts appropriate management of water use, wastewater, waste materials and chemical substances, as well as cleanup activities in the regions in which its production sites are located, in Japan and overseas. In August 2022, the HOYA Group began participating in the JAL Carbon Offset Program. Through this program, the Group offsets the CO2 it emits on business flights to or from Japan on JAL by purchasing carbon credits of the Southern Cardamom Reducing Emissions from Deforestation and Degradation (REDD+)* Project, a tropical rainforest protection program. Preserving the rainforest provides vital regional protection, as it not only preserves a “carbon sink” that absorbs CO2 but also protects wildlife, supports biodiversity, and supports the livelihoods of local residents. By purchasing these carbon credits, the HOYA Group supports this project. In fiscal 2022, the Group purchased credits equivalent to some 130 tons of CO2.

*This carbon project is verified through the Verified Carbon Standard (VCS).