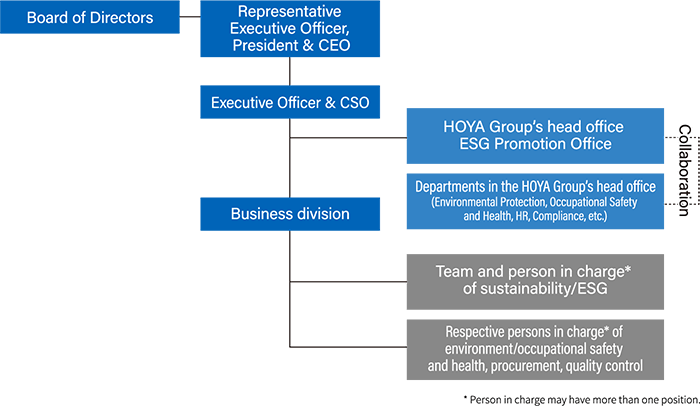

The HOYA Group, which had been engaged in activities centered around the ESG Committee headed by the CEO established in August 2019, appointed a Chief Sustainability (ESG) Officer (CSO) and newly established the ESG Promotion Office—a dedicated organization under the CSO—in the HOYA Group’s head office in March 2022, in order to accelerate sustainability/ESG initiatives. We have also developed a structure to further promote ESG activities in the HOYA Group as a whole while collaborating with the ESG Promotion Office at the head office, after setting up in each business division a sustainability/ESG-related department and personnel in charge in a manner suited to each business division.

Having internally discussed and examined matters that contribute to the HOYA Group’s medium- to long-term growth (i.e., material issues), we completed the task of identifying the material issues and obtained approval for these issues at the Board of Directors’ meeting in September 2021. We will actively promote further efforts for each material issue on a Group-wide basis.

Click here for details.

HOYA appointed its first independent director in 1995, when corporate governance was barely discussed in Japan. In 2003, the Articles of Incorporation were amended to stipulate that more than half of directors be outside directors. Currently, 75% of HOYA’s directors are outside directors, an extremely high level even by global standards. While many companies appoint lawyers, accountants, or academics as outside directors, HOYA’s outside directors primarily consist of persons with extensive experience in corporate management, the fields of which range widely from electrical equipment to medical care, food, trading firm and accounting. In view of gender diversity, the number of female directors increased from one to two, and one female was added as an executive officer. On the back of such diversity, lively discussions take place at meetings of the Board of Directors.

At HOYA, which operates diverse businesses on a global scale, over 90% of all employees work in locations outside Japan. In particular, Asia is home to HOYA’s major manufacturing centers producing eyeglass lenses, HDD substrates, etc., to which approximately 70% of its employees belong. HOYA is also promoting the appointment of local employees to top management positions at its overseas subsidiaries, and its business divisions headed by non-Japanese nationals (as business division CEO) account for 64%.

HOYA actively recruits diverse personnel of different races, ethnic groups, nationalities, religions, etc., in order to gain access to exceptional global talent and create new ideas and values.

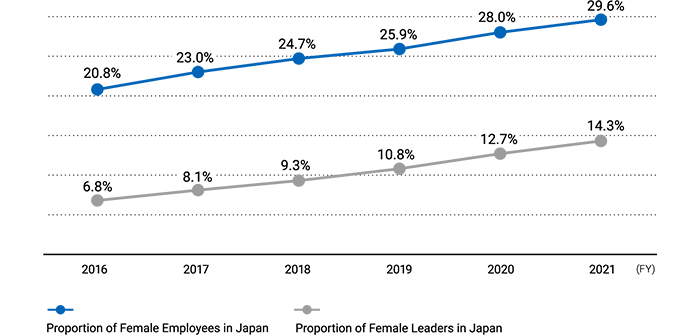

HOYA is increasing the proportion of female employees and leaders as part of its “Minkatsu” diversity project to create a friendly work environment for everyone. In addition to expanded recruitment and occupational fields for women, HOYA holds career advancement seminars for female employees, and promotes cross-divisional exchange.

Due in part to their effects, the proportion of female employees and leaders has been steadily improving in Japan.

In November 2021, HOYA declared its support for the recommendations by the Task Force on Climate-related Financial Disclosures (TCFD) and joined the TCFD Consortium. Currently, we are working on the task of disclosing information related to climate change in accordance with the TCFD recommendations.

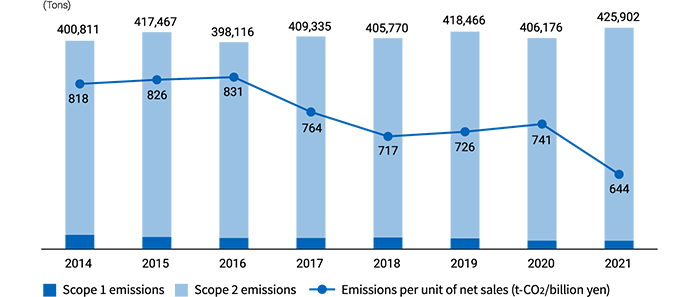

HOYA has been actively engaging in environmental preservation activities as part of its corporate social responsibility in order to pass on to future generations a global environment in better shape than today. In 2021, we identified the reduction of greenhouse gas (CO2) emissions as one of the material issues of the HOYA Group and have since been discussing and examining activities to further reduce them in greater depth. For details on our activities, click here.

In fiscal 2021, HOYA’s CO2 emissions (Scope 1 and 2 emissions) amounted to 425,902 tons, up 4.9% year on year and up 1.8% compared to its fiscal 2019 level. On the other hand, CO2 emissions per unit of net sales are on a downtrend. Of note, in order to further accelerate initiatives to reduce greenhouse gas (CO2) emissions, we have started conducting studies and holding discussions internally on medium- and long-term targets and roadmaps. For fiscal 2022, we are implementing measures tentatively targeted at reducing annual emissions by 1% (compared to the fiscal 2019 level) until our medium- and long-term targets are set.

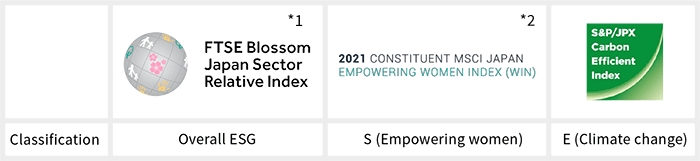

HOYA has been selected as a constituent of the following ESG indexes adopted by the Government Pension Investment Fund (GPIF) of Japan.

As of the end of May 2022

As of the end of May 2022