Eye Health Domain

We provide solutions tailored to each stage of life—from children to the elderly—to support vision and eye health, thereby contributing to improved quality of life (QOL).

Eyeglass lenses

Main Products and Services |

Eyeglass lenses |

|---|---|

Primary Sales Market |

Global (with a high proportion of sales in Europe and North America) |

Customers |

Independent optical retailers, eyewear chains, etc. |

Primary End-User Age Group |

From youth to the elderly |

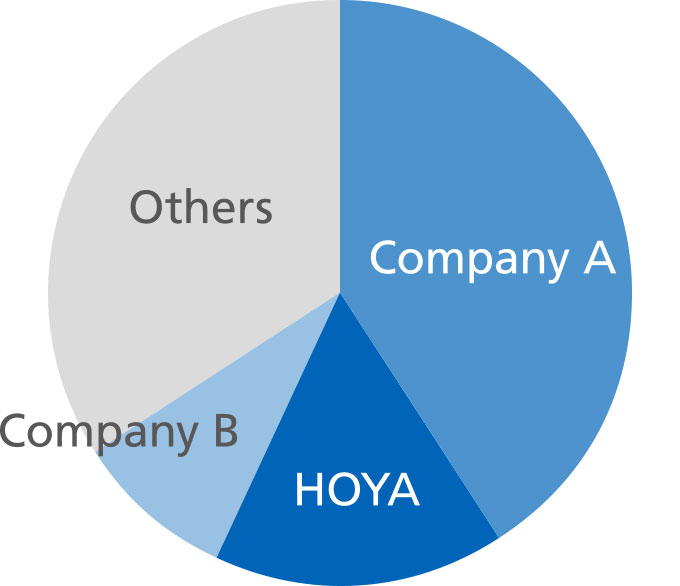

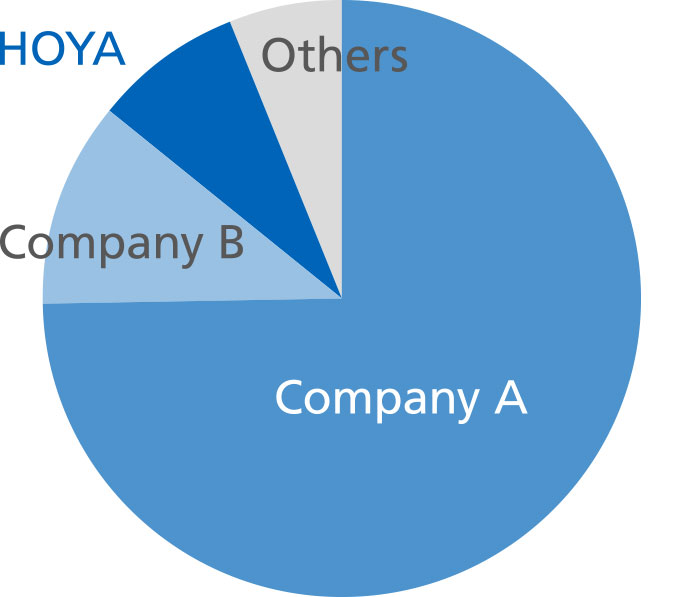

Market Position

HOYA holds the second-largest market share globally. We continue to expand our share through both strategic acquisitions and market share gains from numerous small to medium-sized lens manufacturers, which collectively account for just over 30% of the market.

Estimated Market Share (FY2024)

FY2024 Performance*

Revenue Growth Rate +4%

Despite the impact of an IT incident at the beginning of the fiscal year, we achieved revenue growth through swift recovery efforts and proactive sales and marketing initiatives.

*Growth rate excludes the impact of foreign exchange fluctuations.

Key Focus Areas Moving Forward

Continued development of new products to generate future growth opportunities.

Leveraging our position as an early adopter in the pediatric myopia progression control eyeglass lens space to expand into new markets and drive continued growth in this field.

Expanding our customer base through bolt-on M&A.

MiYOSMART, an eyeglass lens designed for myopia management in younger children (As of September 2025, has not yet received approval in Japan)

Contact Lenses

Main Products and Services |

Operation of “Eyecity,” a retail chain specializing in contact lenses |

|---|---|

Primary Sales Market |

Japan |

Customers |

General consumers |

Primary End-User Age Group |

Teens to those in their 30s |

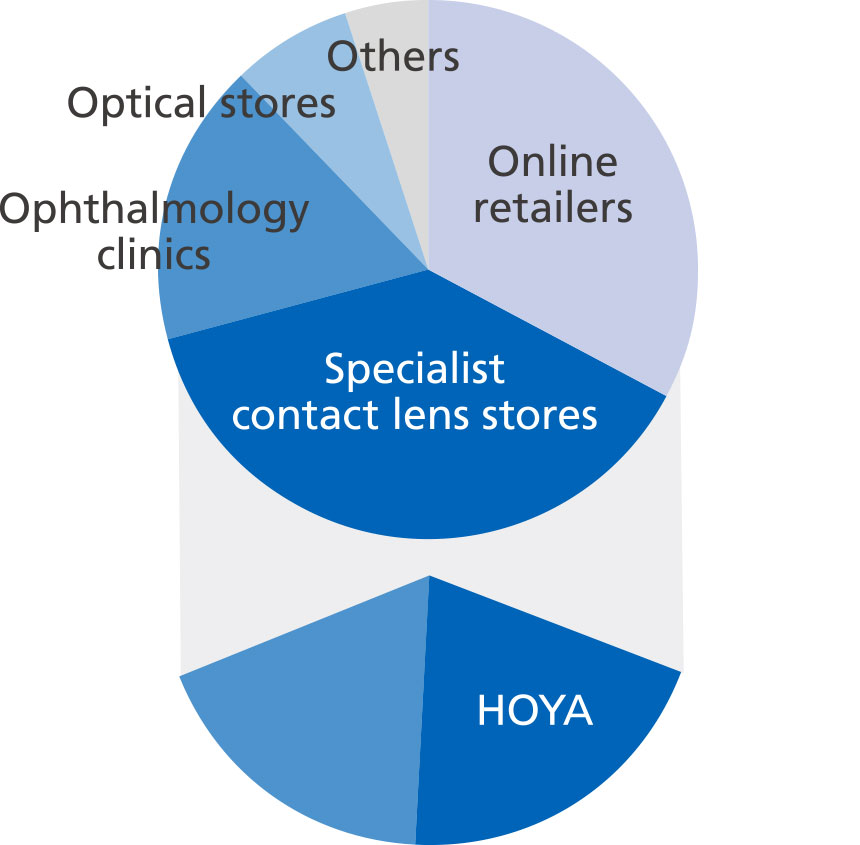

Market Position

HOYA is the market leader in Japan's specialist contact lens retail channel. By leveraging our extensive product lineup and competitive pricing, we continue to gain market share from other channels, such as ophthalmology clinics.

Estimated Market Share (FY2024)

FY2024 Performance*

Revenue Growth Rate +4%

We achieved steady growth through new store openings (+12 YoY), the expansion of omnichannel sales, and the rollout of private-label products.

*Growth rate excludes the impact of foreign exchange fluctuations.

Key Focus Areas Moving Forward

In addition to new store openings, acquiring new customers through bolt-on M&A.

Expanding the lineup of private-label products under the hoyaONE series.

In the medium term, pursuing overseas expansion as a contact lens manufacturer.

hoyaONE Series

Intraocular Lenses

Main Products and Services |

Intraocular lenses for cataract surgery |

|---|---|

Primary Sales Market |

Global (with a high proportion of sales in Japan) |

Customers |

Hospitals, clinics, and ophthalmalogists |

Primary End-User Age Group |

Individuals in their 70s |

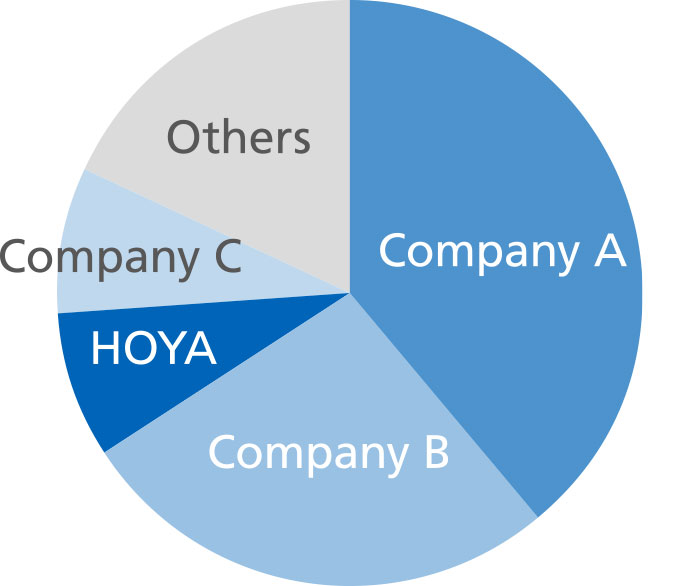

Market Position

HOYA holds the third-largest market share globally. We are steadily expanding this share by leveraging the product competitiveness of Vivinex™, which combines an IOL material that offers unprecedented clarity of vision with multiSert™, our proprietary injector.

Estimated Market Share (FY2024)

FY2024 Performance*

Revenue Growth Rate +1%

Despite the impact of an IT incident and the effects of the volume-based procurement (VBP) system within the China market, HOYA maintained revenue at the prior-year level through increased sales of trifocal lenses.

*Growth rate excludes the impact of foreign exchange fluctuations.

Key Focus Areas Moving Forward

Continuing to launch new products for both lenses and injectors on a consistent basis.

Leveraging our product competitiveness to gain market share, primarily from smaller manufacturers.

Redefining our strategy for the Chinese market, where volume-based procurement pressures persist.

Vivinex™ Gemetric™ Trifocal IOL

Med-Tech Domain

Through our products and services, we are helping to address the needs of an aging society by supporting early disease detection, minimally invasive treatment, and the maintenance and recovery of physical function—thereby contributing to better health outcomes and improved quality of medical care.

Endoscopes

Main Products and Services |

Medical flexible endoscopes |

|---|---|

Primary Sales Market |

Global (with a high proportion of sales in Europe) |

Customers |

Medical institutions such as hospitals and clinics as well as gastroenterologists and other specialists |

Market Position

HOYA holds the third-largest global market share, driven by our state-of-the-art endoscopes for gastrointestinal endoscopy and products designed with enhanced cleanability and disinfection in mind.

Estimated Market Share (FY2024)

FY2024 Performance*

Revenue Growth Rate ー7%

Revenue declined due to sluggish sales in Europe, the primary market, and the impact of the anti-corruption measures in China.

*Growth rate excludes the impact of foreign exchange fluctuations.

Key Focus Areas Moving Forward

Driving a fundamental transformation of the business structure through the formulation and execution of a new long-term strategy, as well as organizational restructuring.

As part of this transformation, streamlining and focusing the product portfolio to align with strategic priorities.

Artificial Bones and Others

|

|

|

|

|

|---|---|---|---|---|

Main |

Artificial bones |

Endoscope disinfection washers |

Laparoscopic surgical instruments, etc. |

Chromatography |

Primary Sales |

Primarily the Japanese market |

Primarily the European market |

Primarily the North American market |

Worldwide |

Customers |

Medical institutions such as hospitals and clinics |

Pharmaceutical companies (via distributors) |

||

Market Position

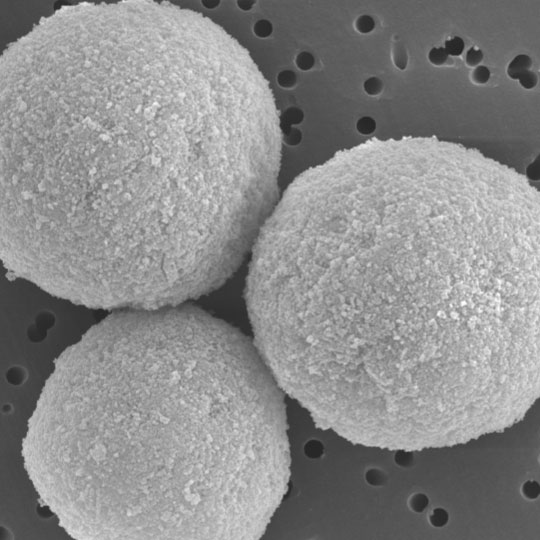

HOYA is recognized as a key player in each of our core product segments—artificial bones, endoscope disinfection washers, laparoscopic surgical instruments, and chromatography media—within their respective markets. Moving forward, we aim to further enhance our market presence through geographic expansion and other strategic initiatives.

FY2024 Performance*

Revenue Growth Rate ー4%

Although sales of artificial bones and endoscope disinfection washers remained solid, overall revenue declined due to inventory adjustments by customers in the chromatography media segment.

*Growth rate excludes the impact of foreign exchange fluctuations.

Key Focus Areas Moving Forward

While the situation varies by product, we will continue to strengthen our portfolio, enhance our manufacturing and supply capabilities, and focus on expanding sales channels and geographic coverage.