CEO Interview with Eiichiro Ikeda

We will respond with agility to increasing uncertainty in the market environment to sustain stable, medium- to long-term growth.

Eiichiro Ikeda

Director, Representative Executive Officer, President & CEO

Despite ongoing economic uncertainty, HOYA achieved record consolidated results for fiscal 2024. From a management perspective, what were the key factors behind this performance?

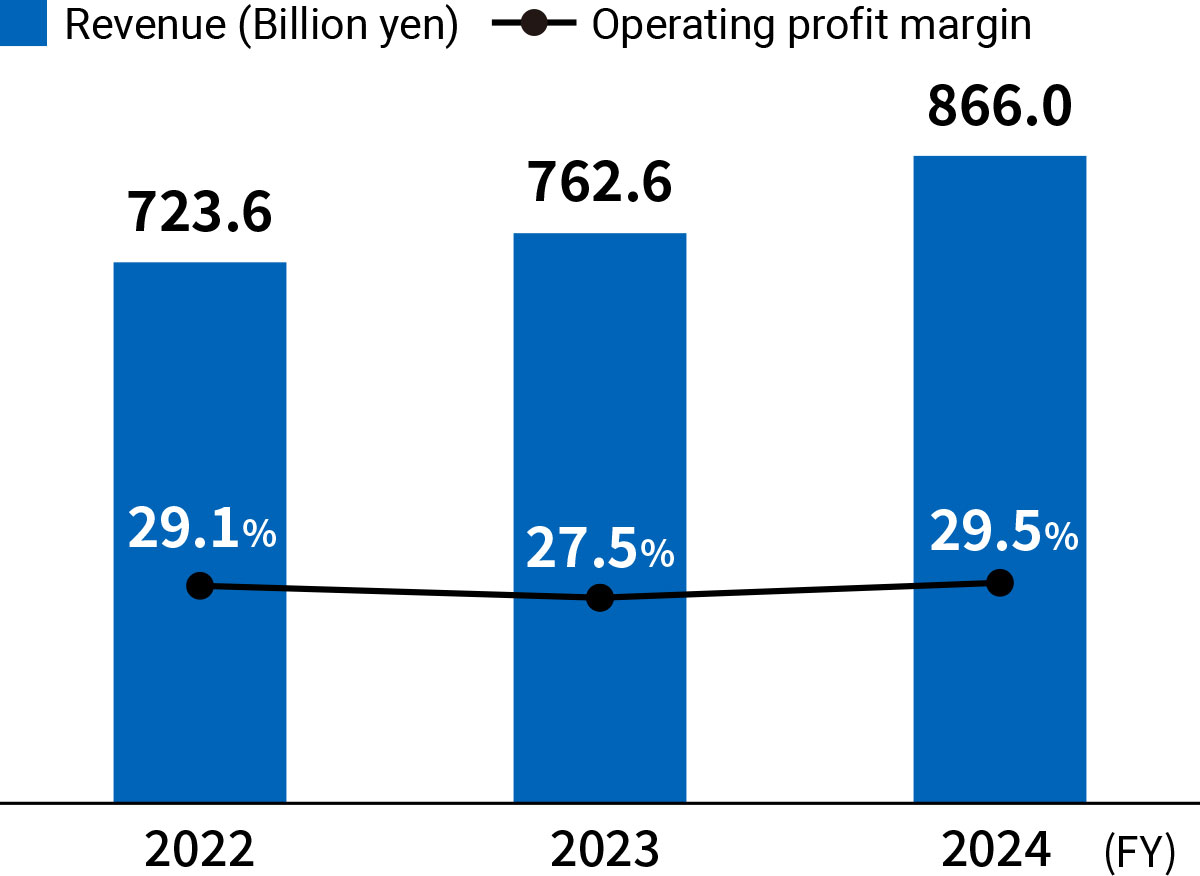

In the fiscal year ended March 31, 2025 (fiscal 2024), we achieved our strongest consolidated results to date. Within the Information Technology business, both revenue and profit increased significantly, particularly for semiconductor mask blanks and glass substrates for nearline hard disk drives (HDDs), supported by a rebound following inventory adjustments in the previous fiscal year. These products served as key drivers of overall performance.

In the Life Care business, although we experienced a temporary setback due to an IT incident early in the fiscal year, we were able to restore our systems promptly and resume proactive sales activities, putting revenue back on a growth track. Profitability remained lower than normal due to increased marketing expenses associated with these efforts, but as those activities wound down during the year, profitability also returned to normal levels. In terms of external factors, our Life Care business in China was affected by a slowing economy and regulatory measures, including the anti-corruption campaign.

Despite these various internal and external developments, we were able to promptly establish a stable supply system in response to strong customer demand for key products in the Information Technology business, which contributed significantly to our strong performance.

Looking back over the past few years, including the pandemic, the external environment has changed at an unprecedented pace, affecting each product in different ways. Nevertheless, HOYA has continued to achieve steady overall growth. How do you personally evaluate the business portfolio strategy to date, and what is your outlook for the future direction of the Company?

Over the past few years, we have faced truly unpredictable changes in the external environment, including the COVID-19 pandemic and the IT incident caused by a cyberattack. Nevertheless, I believe we have continued to achieve steady growth overall.

Our business portfolio is based on a dual-engine structure: the Life Care business, which experiences structural growth driven by societal aging and the rise in myopia; and the Information Technology business, which grows in line with cyclical demand. By combining these two distinct growth trajectories, we aim to ensure stable growth for the Group as a whole.

That said, in our day-to-day operations, we do not rely on a simple binary framework of Life Care versus Information Technology. Instead, we formulate and implement strategies on a product-by-product basis. Each product is also positioned within the portfolio according to its role—whether as a growth driver or a cash cow. HOYA currently operates over 10 business divisions, each handling different products. With such a diverse portfolio, it is rare for all products to perform well at the same time—and likewise, uncommon for all to underperform simultaneously. What matters most, in my view, is timely and agile management: when signs of weakness emerge in a particular business, we adjust production capacity in line with demand, implement cost reductions at the grassroots level, and reallocate resources toward businesses that are performing relatively well.

Performance Over the Past Three Years

What is your view on future market trends and risks? In light of that, how are you identifying and prioritizing key themes for the medium to long term? Could you also share your outlook and major initiatives for fiscal 2025?

The market environment remains uncertain. Geopolitical risks continue to be a central concern, and a range of other risks—such as fluctuations in interest rates and foreign exchange, as well as rising tariffs and inflation—are becoming increasingly evident. Against this backdrop, I believe we will see a growing need for greater flexibility in global business operations, including the diversification of supply chains and the reassessment of production sites over the medium to long term.

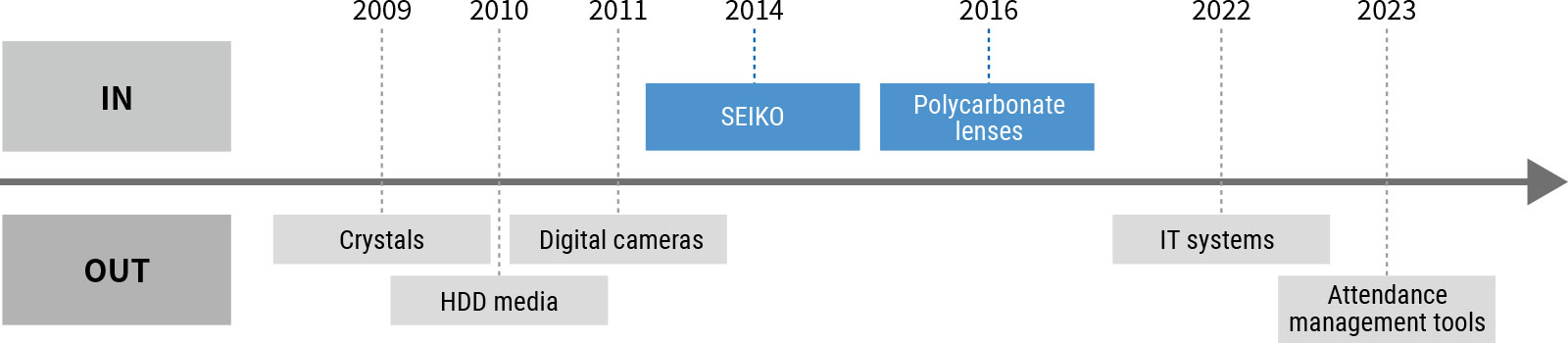

Amid rising macroeconomic uncertainty, the importance of calibrating our business portfolio continues to grow. HOYA has historically divested or exited businesses while also expanding into new areas through internal development and M&A. In recent years as well, we have steadily moved forward with the divestiture of non-core businesses, albeit on a relatively small scale. Looking ahead, it will remain essential to address underperforming businesses in a disciplined manner while identifying and commercializing new growth areas for the medium to long term. We will return to our roots—becoming a “big fish in a small pond”—by securing a strong market presence and high profitability in niche markets, and by continuing to explore areas where we can best leverage our core competencies.

Major Acquisitions and Business Withdrawals Over the Past 15 Years

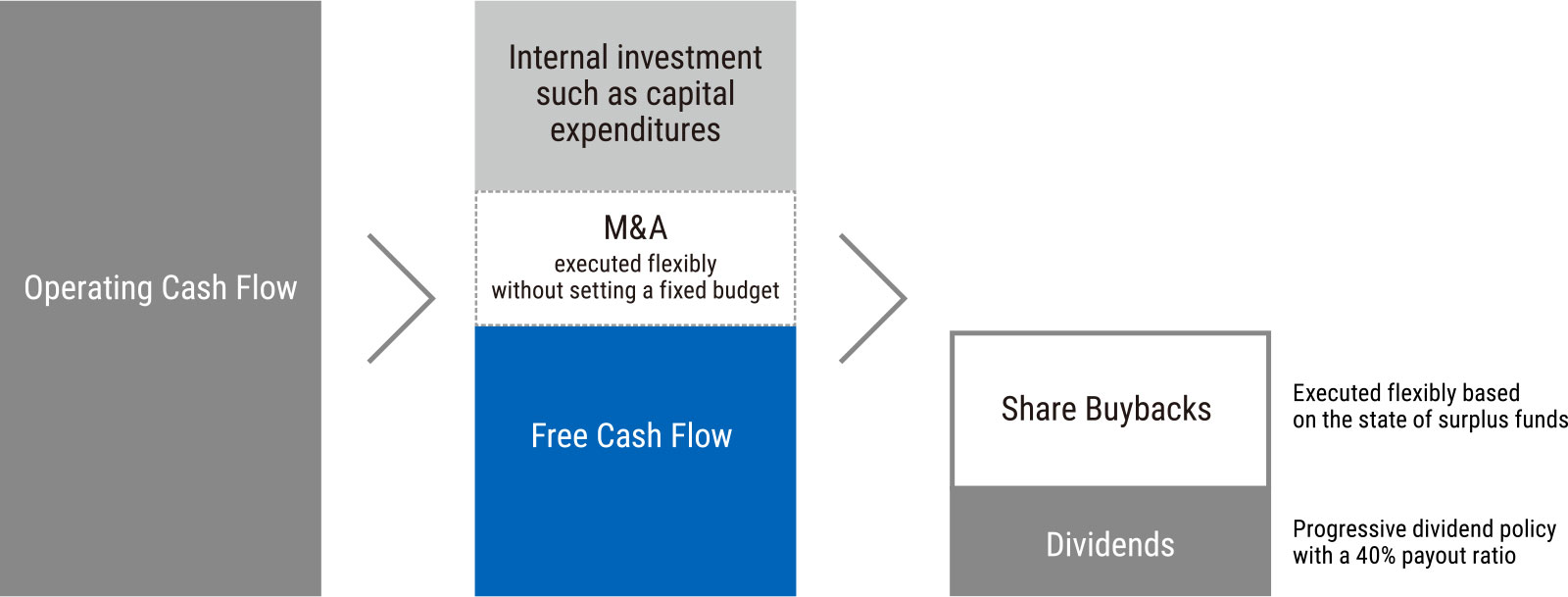

What was the background to the announcement of the new dividend policy? In addition, what is the Company’s approach to capital allocation, including the planned use of its ample cash reserves?

In our communications with investors, our proactive share buybacks have been well received. At the same time, however, concerns were raised regarding the absence of a clearly defined dividend policy and the recent decline in our payout ratio. In light of this feedback, while maintaining our overarching policy of targeting a 100% return of free cash flow to shareholders, we have established a new progressive dividend policy centered on a 40% payout ratio.

Our approach to capital allocation remains unchanged: we will continue to prioritize internal investment, particularly in research and development and the expansion of production capacity, while pursuing M&A based on careful assessment of timing and opportunity. In recent years, although we have increased internal investments, our M&A activity has primarily consisted of relatively small-scale bolt-on acquisitions. In addition, the depreciation of the yen has led to an increase in foreign currency-denominated cash holdings, which has in turn resulted in a higher overall cash balance. Since the 1990s, we have shifted our management focus toward capital efficiency. Going forward, we will continue to enhance both asset efficiency and profitability, further strengthening capital efficiency and striving for sustained growth in corporate value. We appreciate the continued support and guidance of our shareholders and investors.