Life Care Business

Health Care

Eyeglass Lenses

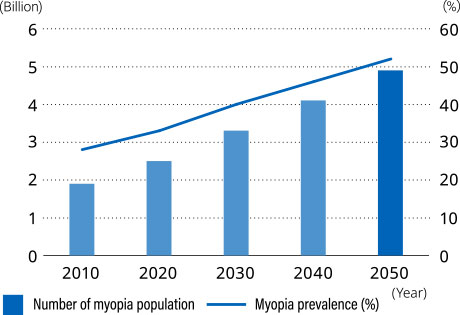

Market Environment

Number of people with Myopia

Source: Holden BA, Fricke TR, Wilson DA, Jong M, Naidoo KS, Sankaridurg P, Wong TY, Naduvilath TJ, Resnikoff S, Global Prevalence of Myopia and High Myopia and Temporal Trends from 2000 through 2050, Ophthalmology, May 2016 Volume 123, Issue 5, Pages 1036–1042

Myopia, also known as short-sightedness, is a common eye condition whereby objects far away appear out of focus, it is a rapidly growing health concern globally. By 2050, an estimated 5 billion people could be affected by myopia and annual myopia progression rate is most rapid under 10 years of age. Childhood myopia is a growing global problem*1 due to factors such as increased near-work activities including the usage of digital devices and spending less time outdoors, but there is a lack of awareness*2 of this condition and impact amongst patients and the parents of children living with myopia.

We are committed to closing the vision health gap and continue our call on governments and public health bodies, as well as the entire healthcare ecosystem to improve eye care health policies globally, allowing children to lead fuller, more inclusive lives.

Concurrently, there is a heightened global awareness of health and well-being. Economic growth in emerging markets has also led to increased purchasing power and a greater emphasis on eye health, thanks to aging population and wider level of awareness (organic growth of presbyopes).

Consequently, the demand for eyeglass lenses is projected to experience stable growth.

Despite uncertainties in the global economic environment, the eyeglass lens market remains relatively resilient. This resilience is attributed to the necessity of eyeglasses and the coverage provided by private and public health insurance in many Western countries.

*1 Holden BA, Fricke TR, Wilson DA, Jong M, Naidoo KS, Sankaridurg P, Wong TY, Naduvilath TJ, Resnikoff S, Global Prevalence of Myopia and High Myopia and Temporal Trends from 2000 through 2050, Ophthalmology, May 2016 Volume 123, Issue 5, Pages 1036?1042

*2 World Economic Forum. Global rates of short-sightedness are rising rapidly, study shows. Accessed April 2024. Myopia: What causes short-sightedness and why is it rising? | World Economic Forum (weforum.org)

Status of Our Business

Business Overview

Our mission is to provide lifelong eyecare solutions, and guided by this purpose, we offer a diverse array of lenses for all stages of life, ranging from general single-vision lenses to progressive (varifocal) lenses for the elderly and myopia control lenses for young children. To ensure we provide the best possible products, we invest heavily in continuous research and development, focusing on improvements in optical design, lens coating, and photochromic lenses*

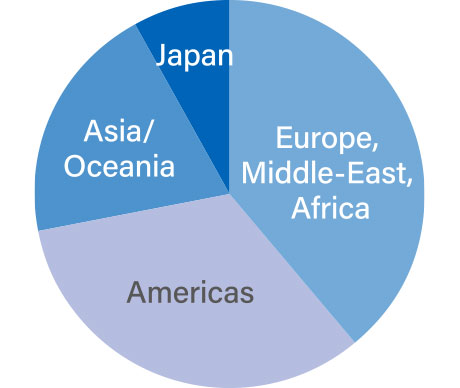

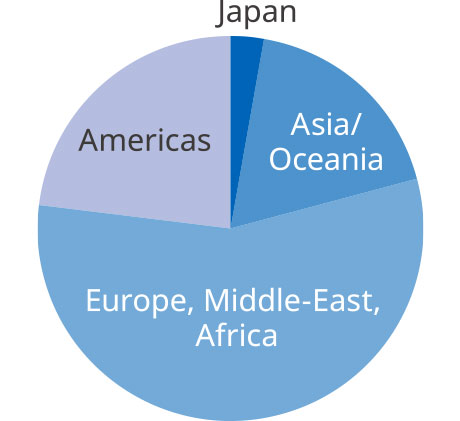

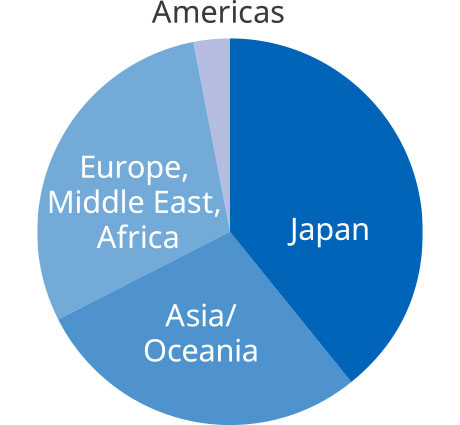

Internationally, overseas net sales constitute 90% of our total revenue, with the highest sales in Europe, followed by the Americas. We operate production facilities worldwide, with significant production volumes in Thailand, Vietnam, Hungary and local manufacturing operations to reinforce our sustainability agenda and prove best possible service to our customers and their consumers.

* Photochromic lenses are those that darken when exposed to UV light.

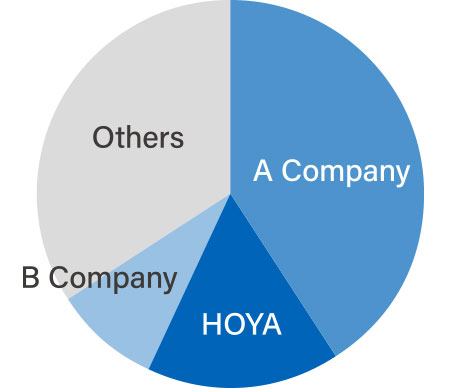

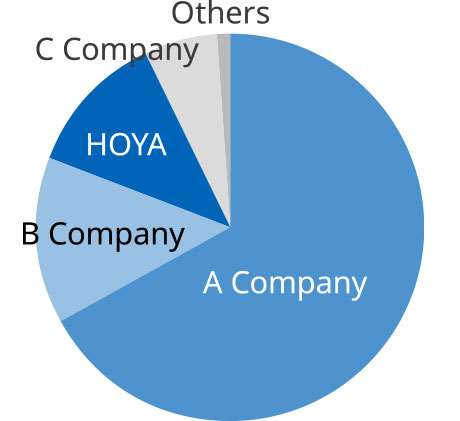

Market Position

HOYA proudly holds the position of the world's second-largest eyeglass lens manufacturer. Our growth strategy includes not only organic expansion but also an increase in market share through strategic mergers and acquisitions.

More than 30% of the market is occupied by numerous small to medium-sized lens manufacturers. By targeting and acquiring these smaller players, HOYA is committed to continuously increasing its market share and solidifying its leadership in the industry. We would also like to strengthen our position by becoming trusted partners, delivering the best and most innovative portfolio of products and solutions, providing great service, and being relevant to customer needs.

Conditions by Region

The market is a mature one, with North America and Europe constituting our most important regions, accounting for approximately 70% of our divisional sales. However, the HOYA Group sees significant growth potential in the United States, where we are actively working to strengthen our local organization and sales capabilities.

In Asia, excluding Japan, our growth in China has been remarkable. We are significantly expanding our sales in China, particularly through our innovative MiYOSMART product (details to follow).

Outlook

The eyeglass lens business is HOYA Group’s largest source of sales, driving the overall expansion of the Life Care business.

We are dedicated to partner with optometrist shops and Eye Care Professionals worldwide to support their growth. To achieve this, we continuously drive innovation in products, practices, and processes; enhance services to our customers with a global presence of manufacturing capability and digitalization of customer interactions; solidify our support to customers and become a relevant partner to their business. Organization sustainability will be the backbone of these initiatives, including digital infrastructure, corporate governance, sustainability and talent management.

Among our notable advancements is MiYOSMART, a lens designed to slow the progression of myopia in younger children. Launched in 2018 ahead of our competitors, MiYOSMART has seen significant growth, particularly in the Chinese market. The product lineup has been expanded to include sunglasses and photochromatic lenses and is now available in more than 30 countries*3.

Beyond China, HOYA plans to intensify promotional activities in Europe thanks to change in the insurance policies. In March 2022, MiYOSMART was recognized as being of public utility by the French Ministry of Health, raising government awareness which should lead to an increase in myopia treatment reimbursement. Since July 1st 2024 in Switzerland, the government has begun to reimburse myopia management solutions for children. This proves the impact we can make by raising awareness, educating, and ensuring governments understand the importance of prioritizing myopia.

Regionally, we are strengthening our sales efforts in high-growth emerging markets, especially in China, to expand our market share.

In the United States, where a significant portion of sales is to independent optometrist shops, we are enhancing our presence with business targeting optometrist chains. Additionally, we are exploring mergers and acquisitions to extend our reach to customers, to deliver better consumer satisfaction and contribute to the category growth.

Through these initiatives, we aim to achieve higher growth than in the past, targeting mid single-digit growth rates.

Market Share

(FY2023)

[HOYA estimate on a value basis]

Sales by Region

(FY2023)

*3 MiYOSMART has not been approved for myopia management in all countries, including the United States, and is not currently available for sale in all countries, including the United States.

As of August 2024, MiYOSMART has not received approval in Japan. For more information, please visit the official MiYOSMART website.

Contact Lenses

Market Environment

The retail market for contact lenses in Japan is growing at a gradual 2% or so annually.

We estimate that the demand for contact lenses will continue to grow even against a background of declining birthrate and population aging, due to rising myopia among the young combined with increasing adoption of bifocal contact lenses among the elderly. In addition, an increase in average unit price per sale due to increased sales of high-value-added lenses is also expected to lead to market growth.

Status of Our Business

Business Overview

Eyecity is HOYA’s contact lens specialty retail store chain, comprising 370 outlets across Japan. Eyecity offers consulting sales, proposing products optimally tailored to each individual customer, backed by a comprehensive lineup of products from major producers worldwide. Outlets are typically situated in convenient locations, such as near train stations and in shopping malls. To cater to today’s growing online shopping needs, HOYA also offers Hoshii Toki Bin (on-demand delivery) and Otoku Teiki Bin (money-saving regular delivery), to enthusiastic customer reception.

In March 2022 HOYA began manufacturing and selling the hoyaONE series of private-brand contact lenses. It currently offers six products in the series.

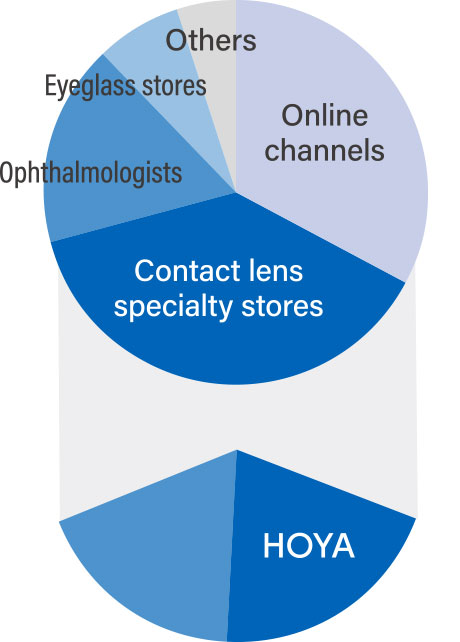

Market Position

HOYA holds more than 50% of the market share in the largest category of contact lens sales channels, contact lens specialty stores. HOYA expects contact lens specialty stores to continue taking market share from ophthalmological channels, owing to their comprehensive lineups and superior prices.

On the other hand, online shopping has been expanding its market share in recent years. HOYA believes that responding to this channel will be vital in assuring the Company’s market position.

Outlook

The Company has been pursuing a strategy of raising its profile by opening 15 to 20 stores a year. HOYA will continue to open new stores and strengthen marketing to attract new customers.

At the same time, we will aim for continuous growth by further expanding our product lineup, including our private-brand series, strengthening our recommendations of high-value-added products such as lenses for astigmatism and bifocal lenses, and enhancing in-store services to increase customer repeat rates and average spending per customer.

Sales Composition Ratio by Sales Channel (FY2023)

HOYA Market Share at Contact Lens Specialty Stores

[HOYA estimate on a value basis]

Medical

Medical Endoscopes

Market Environment

Medical expenses are increasing worldwide in line with the aging of society. To keep medical expenses in check, governments in countries across the globe are promoting the early detection of disease and minimally invasive medical procedures. Minimally invasive medical treatment does not involve the use of a scalpel on the patient’s body and thus minimizes the physical burden on the patient. Due to this demand, endoscopes are attracting a great deal of attention.

The growth of the endoscope market is modest in developed countries. In Asia ex-Japan, however, growth rates remain high, as these countries are still in the early adoption phase. China especially is expected to lead growth in the global market.

Status of Our Business

Business Overview

HOYA conducts research & development, manufacturing, and sales of medical flexible endoscopes used in the examination and treatment of digestive system, ear, nose & throat (ENT), respiratory organs, etc. Medical flexible endoscopes are composed of a scope that is inserted into the patient’s body and a video processor. The Company sells these products to healthcare institutions, organizations that purchase jointly with healthcare institutions, and sales agencies.

Market Position

HOYA is the third largest group in the industry globally. The Group’s strengths lie in the state of the art endoscopes for gastrointestinal endoscopy (GI); small-diameter endoscopes for pulmonology; market leading Ear-Nose-Throat systems composed of endoscopes, processors and stroboscopy systems.

Conditions by Region

Most of the Company’s sales are in Europe and other overseas regions.

Outlook

The demographic profiles of many countries are aging. Also, demand is growing for minimally invasive medical procedures. As a result of these factors, the market for medical endoscopes is forecast to grow in the mid-to-high single digits.

In the near term, the structural reforms implemented in fiscal 2022 in the Americas are steadily bearing fruit and the business there is showing signs of an upturn.

Against the background described above, we will continue to actively pursue continuous technological innovation in both reusable and single-use endoscopes, offer products and solutions that take cleaning and disinfection into consideration, strengthen our sales capabilities, and leverage AI.

Market Share (FY2023)

[HOYA estimate on a value basis]

Sales by Region (FY2023)

PENTAX Medical ONE Pulmo

(Single-use bronchoscope)

PENTAX Medical INSPIRA™ Video Processor EPK-i8020c, i20c series scope

(High-end video processor and video gastroenteroscope)

AquaTYPHOON™

(Automated brushless endoscope channels pre-cleaning system)

PENTAX Medical Discovery™

(AI-equipped endoscopic image diagnosis support software)

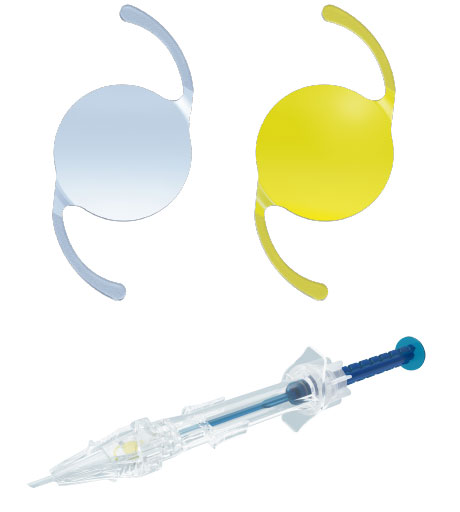

Intraocular Lenses

Market Environment

As populations age around the world, medical infrastructure spreads in emerging countries and access to advanced medical technology improves, demand for intraocular lenses for cataracts is rising. Cataracts are a disease in which a cloudy white area forms in the crystalline lens of the eye, causing vision to deteriorate. Probability of suffering cataracts increases with age and is the greatest cause of eyesight loss in the world today. In cataract surgery, the natural lens that has developed the cataract is replaced with a new, clear IOL.

In addition to conventional unifocal lenses, in recent years high-end products such as trifocal lenses and lenses with deep focal depth have entered the market, resulting in mid-single digit market growth.

Status of Our Business

Business Overview

In this field, we perform research and development, manufacturing, and sales of intraocular lenses (IOLs) for cataract surgeries.

Drawing on over 30 years of experience and expertise in the IOL business, HOYA has contributed to improving the vision and quality of life of millions of cataract sufferers.

HOYA pre-loaded IOLs* combine HOYA’s strengths in optical technology with the Group’s experience and expertise in developing injectors for intraocular lenses. These advantages have earned admiration on the global market, propelling the HOYA Group to top market share in this category.

* In a pre-loaded injector, the intraocular lens is pre-installed in the injector, supporting safer and more reliable surgeries.

Vivinex™

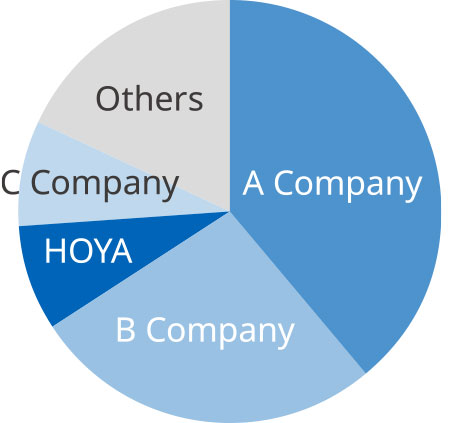

Market Position

HOYA is steadily increasing its market share and currently holds the global No. 3 position.

Driven by the flagship brand, Vivinex™ (launched in 2015), sales continue to grow at a pace that is above the market. Vivinex™ combines an IOL material that offers unprecedented clarity of vision with multiSert™, our proprietary 4-in-1 injector, which is designed to provide outstanding IOL delivery consistency.

Status by Region

In a breakdown of net sales by region, Japan accounts for about 40% of HOYA’s worldwide net sales.

HOYA is continually expanding the roster of countries in which it sells. As a result, our overseas sales ratio is expected to rise.

Outlook

By bolstering sales of Vivinex Gemetric trifocal IOLs, a high-value-added product, HOYA is meeting the needs and expectations of a wider range of customers.

In addition to bolstering our sales workforce in regions in which we already have sales bases, we are establishing sales companies and reaching out to sales agencies in regions in which we do not yet have a presence. In this way we are widening our total addressable market. In January 2023 the HOYA Group established a sales company in South Korea, a country where demand for IOLs is rising.

Although the sales growth rate is expected to slow temporarily in fiscal 2024 due to the cyber attack at the beginning of the fiscal year, we intend to outpace the market growth rate (mid-single digits) for IOLs.

Market Share (FY2023)

[HOYA estimate on a value basis]

Sales Composition of HOYA Surgical Optics by Region (FY2023)

Ceramic Artificial Bones, Metal Orthopedic Implants

Market Environment

As Japan’s demographic profile ages, bone fractures and disease are on the rise. The market for orthopedic and neurosurgical implants effective in their treatment is expected to continue to grow.

Status of Our Business

Business Overview

HOYA develops and manufactures ceramic artificial bones and metal implants, which are used to compensate for bone loss and repair bone fractures. The Company mainly supplies these products to healthcare facilities in Japan, where they contribute to the treatment of numerous patients.

Market Position

In the ceramics market, HOYA was the first company in Japan to manufacture and sell a hydroxyapatite product with more or less the same constituents as a human bone and has led the Japanese market ever since. HOYA entered the market of metal implants in 2012, through management integration with Japan Universal Technologies, Inc. We manufacture and sell implants that are optimized to the skeletal structure of Japanese people in terms of shape and size. In metal orthopedic implants for distal radius fractures, HOYA offers an extensive product lineup that has captured the top market share in Japan (HOYA survey, case basis).

Outlook

By maintaining its share of the ceramic artificial bone market and developing new applications, the Company expects to expand its market. HOYA will respond to patient and healthcare-facility needs by extending its lineup of metal implant products and bolstering its sales capabilities. Leveraging its strength as both a manufacturer and vendor of both ceramic artificial bone and metal implants, HOYA aims to combine products of both materials to propose new surgical procedures, thereby differentiating itself from the competitors.

Bioactive ceramic implant BIOPEX

Metal orthopedic implant HTS Stellar D for distal radius fractures

Chromatography Media

Market Environment

The market of separation/purification media (chromatography media) used in the development and production of biopharmaceutical products is expected to grow at a rate above mid-single digits globally in the years ahead, due to the expansion of the biopharmaceuticals market.

Status of Our Business

Business Overview

The Company manufactures bioceramic chromatography media and sells them through distributors. The products are adopted by pharmaceutical companies and research facilities worldwide.

Market Position

A wide range of methods are used to separate and refine biopharmaceuticals. HOYA’s spherical ceramic hydroxyapatite media possess high capacity for absorption of various proteins, enabling efficient removal and powerful separation of impurities in the purification process. As such, these unique products enjoy strong market favor.

Outlook

Market needs for biopharmaceuticals are many and diverse, extending to antibody preparations, vaccines, gene therapies and more. To cater to these needs and secure further growth, the HOYA Group is working with customers and research institutes to accelerate the development of products and refining processes and is expanding production capacity to respond to growing demand.

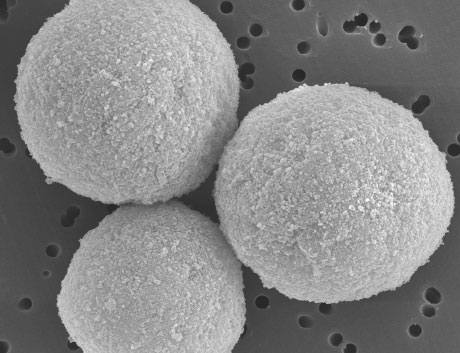

Chromatography media

(enlarged image)