Maximizing Shareholder Value

Advanced corporate governance structure

To ensure the effective functioning and objectivity of the management supervisory function, five out of seven directors are independent outside directors. As a monitoring board, outside directors enhance the quality of corporate governance by applying their wealth of management experience, insight and leadership ability to HOYA’s management.

Background of Outside Directors |

|||||||

|---|---|---|---|---|---|---|---|

Corporate |

Global |

Finance/ |

IT/ |

M&A |

Sustainability/ESG |

Medical |

|

Hiroaki |

● |

● |

● |

● |

● |

● |

|

Yasuyuki |

● |

● |

● |

● |

● |

||

Takayo |

● |

● |

● |

● |

|||

Mika |

● |

● |

● |

● |

|||

Mototsugu |

● |

● |

● |

● |

● |

||

Pursuing capital efficiency

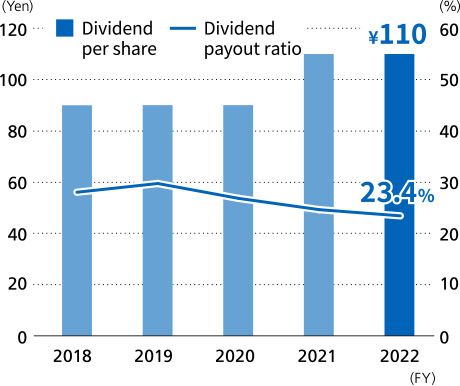

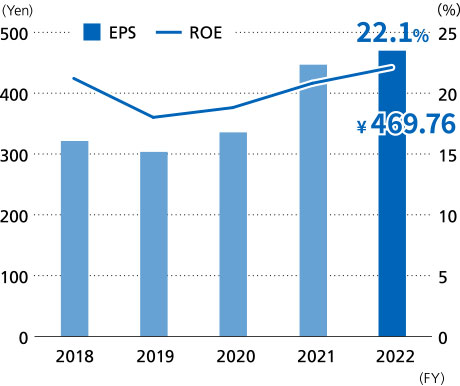

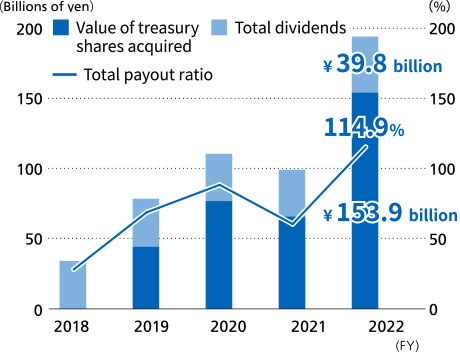

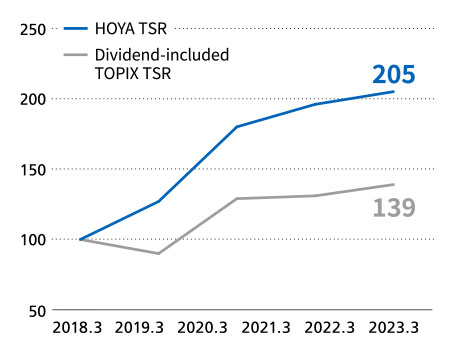

Return to shareholders and capital efficiency are among the key management considerations at HOYA.

Major management indicators and return to shareholders

Dividend per Share

ROE and EPS

Return of Value to Shareholders

Total Shareholder Return (TSR)

This indicates the investment performance by taking share price changes and dividends into consideration, assuming that an index of 100 equals the amount of investment on March 31, 2018.