Remuneration for Directors and Executive Officers

Policy Concerning Remuneration for Directors

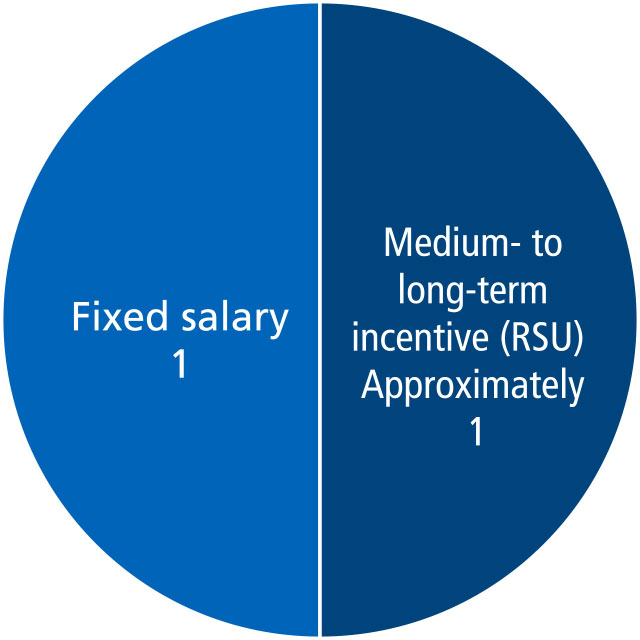

The remuneration of directors consists of a fixed salary and a medium- to long-term incentive (Restricted Stock Unit (hereinafter referred to as the “RSU”). The fixed salaries consist of a basic compensation and compensation for being a member or a chairperson of the Nomination, Compensation, or Audit Committee. The compensation levels are set appropriately by taking into consideration such factors as the Company’s business environment, the levels set by other companies as determined by a survey conducted by an outside professional organization, and the positions and responsibilities of each director. RSU is a system introduced in fiscal 2022 to replace stock options. Under this program, a predetermined number of shares are granted to outside directors based on their tenure with the Company. The aim is to align their perspective with that of shareholders regarding share price performance and to promote the sharing of interests over the medium to long term.

In fiscal 2024 as well, the Compensation Committee deliberated on appropriate composition and levels of remuneration, taking into consideration basic policies, the Company’s business environment, the levels set by other companies as determined by a survey conducted by an outside professional organization, and the positions and responsibilities of each director. The Compensation Committee determined the remuneration for each director, based on the judgement that remuneration levels were composed in accordance with Company policy and appropriate for directors’ positions and responsibilities. As such, the Compensation Committee further judged that the details of remuneration of individual directors in the fiscal year under review were in accordance with Company policy.

RSUs are granted annually in order for directors to share a common viewpoint with shareholders regarding the share price and to share interests with shareholders on a medium- to long-term basis. Every year, the Company announces a basic deliverable number of shares equivalent to fixed remuneration to outside directors for a three-year period from that year. After the end of the period in question, the Company determines, for each outside director, a basic compensation amount which is the market value of the Company's shares for the basic deliverable number of shares. The Company will pay to the outside directors 50% of the basic compensation amount as claims for monetary remuneration. Independent directors shall invest the monetary claims in kind and shall be granted a number of Company shares, which is equal to the amount of monetary claims in question divided by paid-in amount per Company share. From the viewpoint of ensuring payment of tax, the Company shall pay the remainder of the basic compensation amount in cash. However, the heirs of outside directors who died during their tenure and outside directors who retire due to injury or illness shall receive the entire basic compensation amount in cash. Also, the Company plans to issue RSU for periods of three years starting from the following fiscal year, and continuing thereafter.

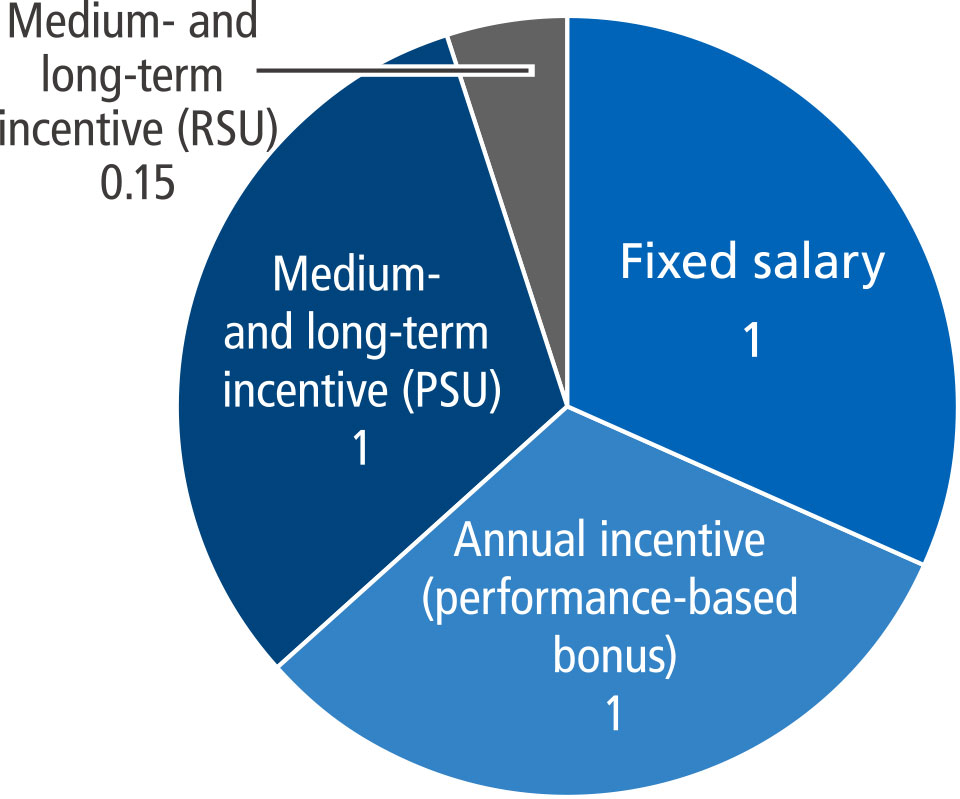

[Composition ratio of compensation for directors]

Assuming a share price in three years roughly equivalent to the share price when the RSU was granted.

Clawback and malus clauses:

In the following cases, clawback and malus clauses shall be set forth, whereby the unpaid portion of the compensation under the RSU shall be reduced or disallowed, and a claim for return of all or part of such paid portion shall be made.

(1) The case in which the recipient resigns for personal reasons, for whatever reason

(2) The case in which the recipient is dismissed as a director of the Company

(3) The case in which Board of Directors resolves to revise the financial statements as a result of material accounting error or fraud

(4) The case in which an unlawful act, such as significant negligence of duties or violation of laws and regulations, a breach of the internal rules of HOYA Group, or a significant breach of contract, during the director’s term of office, is revealed

Policy Concerning Remuneration for Executive Officers

The remuneration of executive officers for fiscal 2024 consists of a fixed salary, an annual incentive (performance-based bonuses), and a medium- and long-term incentive (Performance Share Unit (PSU)). For fixed salaries, basic compensation is set appropriately according to the office and responsibility of each Executive Officer (Representative Executive Officer, CFO, etc.) and benefits granted to expatriates in connection to their overseas postings (such as home leave allowances) are set at appropriate levels in consideration of the Company’s business environment and the levels set by other companies as determined by a survey conducted by an outside professional organization. Since 2003, the Company has abolished retirement benefits for executive officers, but in exceptional cases, severance pay may be paid as a condition at the time of retirement, as determined by the Compensation Committee. The amount of severance pay and other details will be determined on a holistic basis by the Compensation Committee on a case-by-case basis, taking into consideration the position, reason for leaving the position, and other factors.

The performance-based bonus is determined according to quantitative results and qualitative evaluations and varies within the range roughly from 0% to 200%. As indicators of quantitative results, revenue, profit attributable to owners of the Company, and basic earnings per share (EPS) stated in the Consolidated Financial Statements of the Company are selected.

Starting in fiscal 2025, we will introduce RSUs for executive officers with the aim of raising awareness and motivation to contribute to the enhancement of the HOYA Group’s medium- to long-term corporate value. This initiative also seeks to attract and retain top talent by offering a compensation structure and level that are competitive with those of leading global companies.

■Performance share unit (PSU)

The PSU was introduced in place of the existing stock option plan from fiscal 2019. The PSU is a system for granting shares at a number that is in proportion to the level of achievement of the predetermined performance conditions. The payment ratio that corresponds to the level of achievement of the performance targets will range from 0% to 200%, based on performance during three fiscal years.

As performance indicators for the three-year target period, HOYA has selected consolidated revenue, earnings per share (EPS), and return on equity (ROE), along with ESG-related indicators such as evaluations by external organizations and the status of initiatives addressing ESG themes prioritized by the Company.

In fiscal 2024 as well, the Compensation Committee deliberated on appropriate composition and levels of remuneration, taking into consideration basic policies, the Company’s business environment, the levels set by other companies as determined by a survey conducted by an outside professional organization, and the positions and responsibilities of each executive officer. The Compensation Committee determined the remuneration for each executive officer, based on the judgement that remuneration levels were composed in accordance with Company policy and appropriate for executive officers’ positions and responsibilities. As such, the Compensation Committee further judged that the details of remuneration of individual executive officers in the fiscal year under review were in accordance with Company policy.

■Restricted stock unit (RSU)

Starting in fiscal 2025, HOYA will introduce a new RSU program for executive officers. Under this program, a baseline number of shares is granted each year based on a one-year term of service (CEO: base remuneration × 0.25 ÷ base share price; other executive officers: base remuneration × 0.15 ÷ base share price).

The granted RSUs are accumulated and managed throughout the executive officer’s tenure. Upon retirement, the Company calculates the total value of the accumulated RSUs based on the market price of HOYA shares. 50% of this value is provided as monetary compensation, which is then used to allocate HOYA shares to the retiring executive officer at the applicable issue price.

To ensure sufficient funds for tax obligations, the remaining 50% of the compensation is paid in cash.

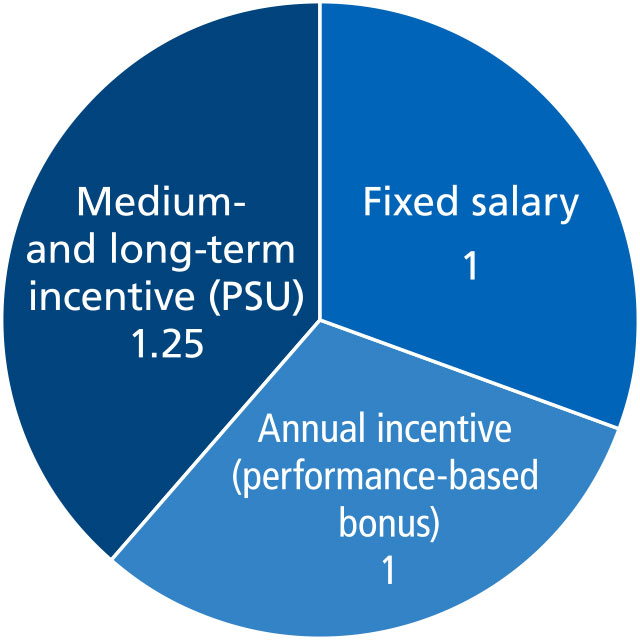

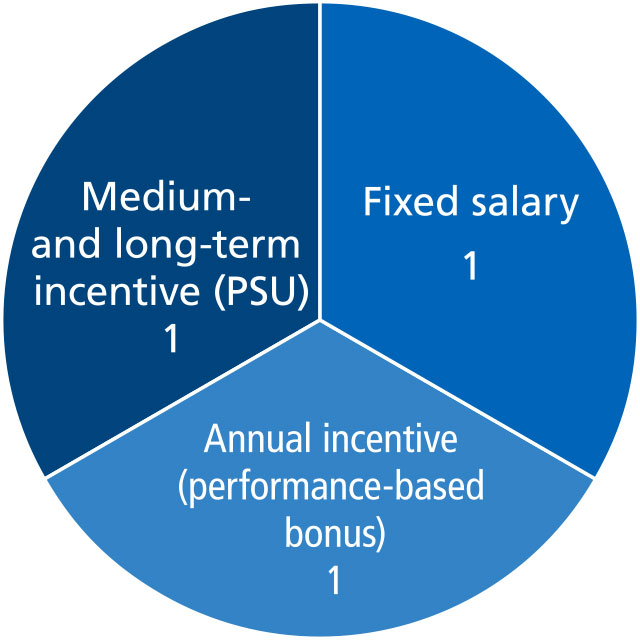

[FY24 Composition ratio of compensation for executive officers]

CEO

Other executive officers

Assuming a share price in three years roughly equivalent to the share price when the PSU was granted.

Clawback and malus clauses:

In the following cases, clawback and malus clauses shall be set forth, whereby the unpaid portion of the compensation under the PSU shall be reduced or disallowed, and a claim for return of all or part of such paid portion shall be made.

(1) The case in which the recipient resigns for personal reasons, for whatever reason

(2) The case in which the recipient is dismissed as an executive officer of the Company

(3) The case in which Board of Directors resolves to revise the financial statements as a result of material accounting error or fraud

(4) The case in which an unlawful act, such as significant negligence of duties or violation of laws and regulations, a breach of the internal rules of HOYA Group, or a significant breach of contract, during the Executive Officer’s term of office, is revealed.

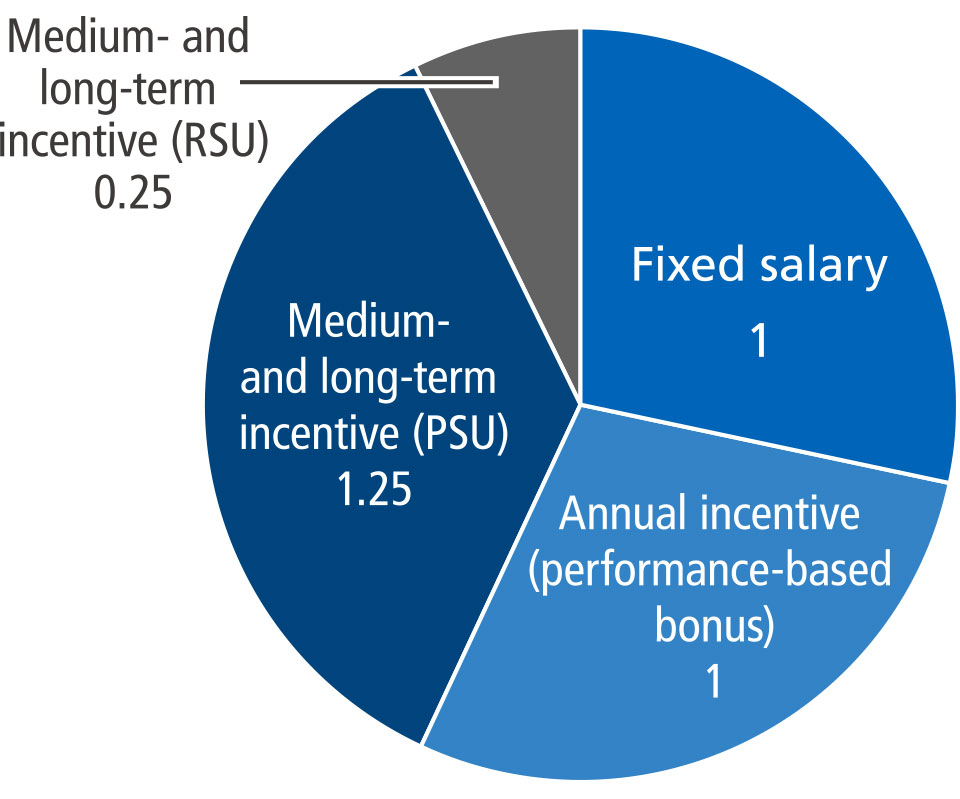

[Composition ratio of compensation for executive officers from FY25 Onward]

CEO

Other executive officers

Assuming a share price in three years roughly equivalent to the share price when the PSU or RSU was granted.

Clawback and malus clauses:

In the following cases, clawback and malus clauses shall be set forth, whereby the unpaid portion of the compensation under the PSU and RSU shall be reduced or disallowed, and a claim for return of all or part of such paid portion shall be made. (1) The case in which the recipient resigns for personal reasons, for whatever reason

(2) The case in which the recipient is dismissed as an executive officer of the Company

(3) The case in which Board of Directors resolves to revise the financial statements as a result of material accounting error or fraud

(4) The case in which an unlawful act, such as significant negligence of duties or violation of laws and regulations, a breach of the internal rules of HOYA Group, or a significant breach of contract, during the Executive Officer’s term of office, is revealed.

[Performance-linked coefficient (Performance-linked bonuses)]

Indicator |

Target |

Actual |

Reason for the selection |

|---|---|---|---|

Revenue |

769.6 billion yen |

866.0 billion yen |

Selected as an indicator for its |

Profit attributable to |

170.0 billion yen |

202.1 billion yen |

Selected as an indicator for its |

Earnings per share (EPS) |

483.22 yen |

581.45 yen |

Selected as an indicator for its |

The qualitative assessment method relevant to an annual incentive (performance-based bonuses) involves assessments

of items such as the degree of achievement of budget targets in the division under management. Final decisions are made following deliberation by the Compensation Committee.The target values in the table above are set taking into consideration factors such as the Company’s business environment,

and as such may differ from performance forecasts.

[Performance-linked coefficient PSU]

Basic deliverable number of shares

Position/ |

Basic |

|---|---|

CEO |

8,900 |

CFO |

4,100 |

CSO |

3,100 |

Medium- to long-term performance targets

(target period: fiscal year ended March 2026 to fiscal year ended March 2028)

Note that the details below are subject to change based on decisions of the Compensation Committee

Indicator |

Target |

Weight |

Reason for |

|

|---|---|---|---|---|

Financial Indicators *1 |

Revenue |

980 billion yen |

25% |

Selected as an indicator to measure growth potential of the HOYA Group in the domestic and overseas markets |

Earnings per |

670 yen |

25% |

Selected as an indicator to measure growth of the Company from the same perspective as shareholders |

|

ROE |

20.00% |

25% |

Selected as an indicator to measure whether the Company has generated return on shareholders’ investment effectively |

|

ESG |

Status of initiatives for the key ESG themes |

25% |

Evaluation by external organizations (50%)*2, |

|

*1 The targets shown above are set by taking into account the Company’s business environment, market consensus, and so on, and is not a financial forecast.

*2 We use evaluations from two organizations, CDP and DJSI.

*3 Figures in parentheses represent weights within ESG targets.

Fiscal 2022 allocation

(Target period: fiscal year ended March 2023 to fiscal year ended March 2025)

Indicator |

Target |

Weight |

Actual |

Reason for |

|

|---|---|---|---|---|---|

Financial Indicators |

Revenue |

760 billion yen |

30% |

784.1 billion yen |

Selected as an indicator to measure growth potential of the HOYA Group in the domestic and overseas markets |

Earnings per |

560 yen |

30% |

522 yen |

Selected as an indicator to measure growth of the Company from the same perspective as shareholders |

|

ROE |

20.0% |

30% |

20.6% |

Selected as an indicator to measure whether the Company has generated return on shareholders’ investment effectively |

|

ESG |

Evaluation by external |

10% |

* |

Selected as indicators to measure the initiatives relating to sustainability from an ESG persective |

|

* We use two main indicators to measure our sustainability initiatives: “evaluations by external rating agencies” and “status of initiatives for the key ESG themes.” For evaluations by external rating agencies, we have selected assessments from the following three organizations as benchmarks.

[Evaluation scores (listed in order of highest rating by each company)]

MSCI: Seven rating levels (AAA, AA, A, BBB, BB, B, CCC)

Sustainalytics (“S”): Five rating levels (Negligible / Low / Medium / High / Severe)

CDP (Climate Change Score): Eight rating levels (A, A-, B, B-, C, C-, D, D-)

Based on our 2021 ratings—MSCI: A, S: Low, and CDP: C—we set targets as MSCI: AA, S: Negligible, and CDP: B. In fiscal 2024, our results were MSCI:

AAA, S: Low, and CDP: B. As part of our efforts to address key ESG themes, we have chosen the “renewable energy ratio” as a focus area.

With the long-term goal of reaching 100% by fiscal 2040, we set an interim goal of 30% for the target period. In the fiscal year under review, the renewable energy ratio reached 19%.

Fiscal 2023 allocation

(target period: fiscal year ended March 2024 to fiscal year ending March 2026)

Indicator |

Target |

Weight |

Actual |

Reason for |

|

|---|---|---|---|---|---|

Financial Indicators |

Revenue |

800 billion yen |

25% |

ー |

Selected as an indicator to measure growth potential of the HOYA Group in the domestic and overseas markets |

Earnings per |

560 yen |

25% |

ー |

Selected as an indicator to measure growth of the Company from the same perspective as shareholders |

|

ROE |

20.0% |

25% |

ー |

Selected as an indicator to measure whether the Company has generated return on shareholders’ investment effectively |

|

ESG |

Evaluation* by |

25% |

ー |

Selected as indicators to measure sustainability initiatives from an ESG perspective |

|

*The evaluations from three companies (CDP, DJSI and Sustainalytics) are used.

Fiscal 2024 allocation

(target period: fiscal year ended March 2025 to fiscal year ending March 2027)

Indicator |

Target |

Weight |

Actual |

Reason for |

|

|---|---|---|---|---|---|

Financial Indicators |

Revenue |

830 billion yen |

25% |

ー |

Selected as an indicator to measure growth potential of the HOYA Group in the domestic and overseas markets |

Earnings per |

570 yen |

25% |

ー |

Selected as an indicator to measure growth of the Company from the same perspective as shareholders |

|

ROE |

20.0% |

25% |

ー |

Selected as an indicator to measure whether the Company has generated return on shareholders’ investment effectively |

|

ESG |

Status of |

25% |

ー |

Development of IT governance (50%), promoting diversity in management (30%), expansion of learning opportunities for employees (20%) were selected as individual indicators* |

|

* Figures in parentheses represent weights within ESG targets.

Total amount of remuneration, etc. of Directors and Executive Officers for the fiscal year under review

Classification |

Number of |

Total amount |

Total amount |

|||||

|---|---|---|---|---|---|---|---|---|

Fixed |

Performance-based |

Stock |

PSU |

RSU |

||||

Directors |

Independent |

5 persons |

129 million yen |

74 million yen |

- |

13 million yen |

- |

42 million yen |

Internal |

2 persons |

10 million yen |

10 million yen |

- |

- |

- |

- |

|

Total |

7 persons |

139 million yen |

84 million yen |

- |

13 million yen |

- |

42 million yen |

|

Executive |

3 persons |

736 million yen |

221 million yen |

303 million yen |

- |

212 million yen |

- |

|

Total |

10 persons |

876 million yen |

306 million yen |

303 million yen |

13 million yen |

212 million yen |

42 million yen |

|

At the end of the fiscal year under review, there were seven directors (five independent directors and two internal directors) and three executive officers (two are concurrently directors).

For stock options, the fair value of stock acquisition rights was calculated and amounts to be recorded as expenses for fiscal 2024 are shown in the table above. For executive officers, no stock options were newly granted in fiscal 2024 due to the introduction of PSU in place of stock options from fiscal 2019. Also, for independent directors, from fiscal 2022 RSU is introduced in place of stock options. Although no stock options were granted in fiscal 2024, the table above shows stock options granted in past fiscal years in amounts to be recorded as expenses for fiscal 2024.

For PSU and RSU, the table above shows amounts to be recorded as expenses for fiscal 2024.

[Amount of consolidated remuneration for each Director]

Chief Executive Officer (CEO)

Name |

Executive |

Total |

Fixed |

Performance- |

Stock |

PSU |

|---|---|---|---|---|---|---|

Eiichiro Ikeda |

Director |

5 million yen |

5 million yen |

- |

- |

- |

Representative |

369 million yen |

111 million yen |

150 million yen |

- |

109 million yen |

Executive Officers (whose consolidated remuneration, etc. totaled 100 million yen or more during the consolidated fiscal year)

Name |

Executive |

Total |

Fixed |

Performance- |

Stock |

PSU |

|---|---|---|---|---|---|---|

Ryo Hirooka |

Director |

5 million yen |

5 million yen |

- |

- |

- |

Representative |

219 million yen |

65 million yen |

88 million yen |

- |

65 million yen |

|

Tomoko Nakagawa |

Executive |

149 million yen |

46 million yen |

66 million yen |

- |

37 million yen |